Quick Answer: Tarneit, Box Hill, Bundaberg, Caloundra, Mackay, Roxburgh Park, Maryborough, Kellyville, Toowoomba, and Werribee were Australia’s Top 10 Greenest Suburbs in 2023.

Australia’s push towards sustainability is boldly marked by the solar installations sprouting up in suburbs across the nation. Using publicly available data from the Clean Energy Council (CEC), Solar Run calculated the total number of solar installations in every Australian suburb between January 2020 and December 2023.

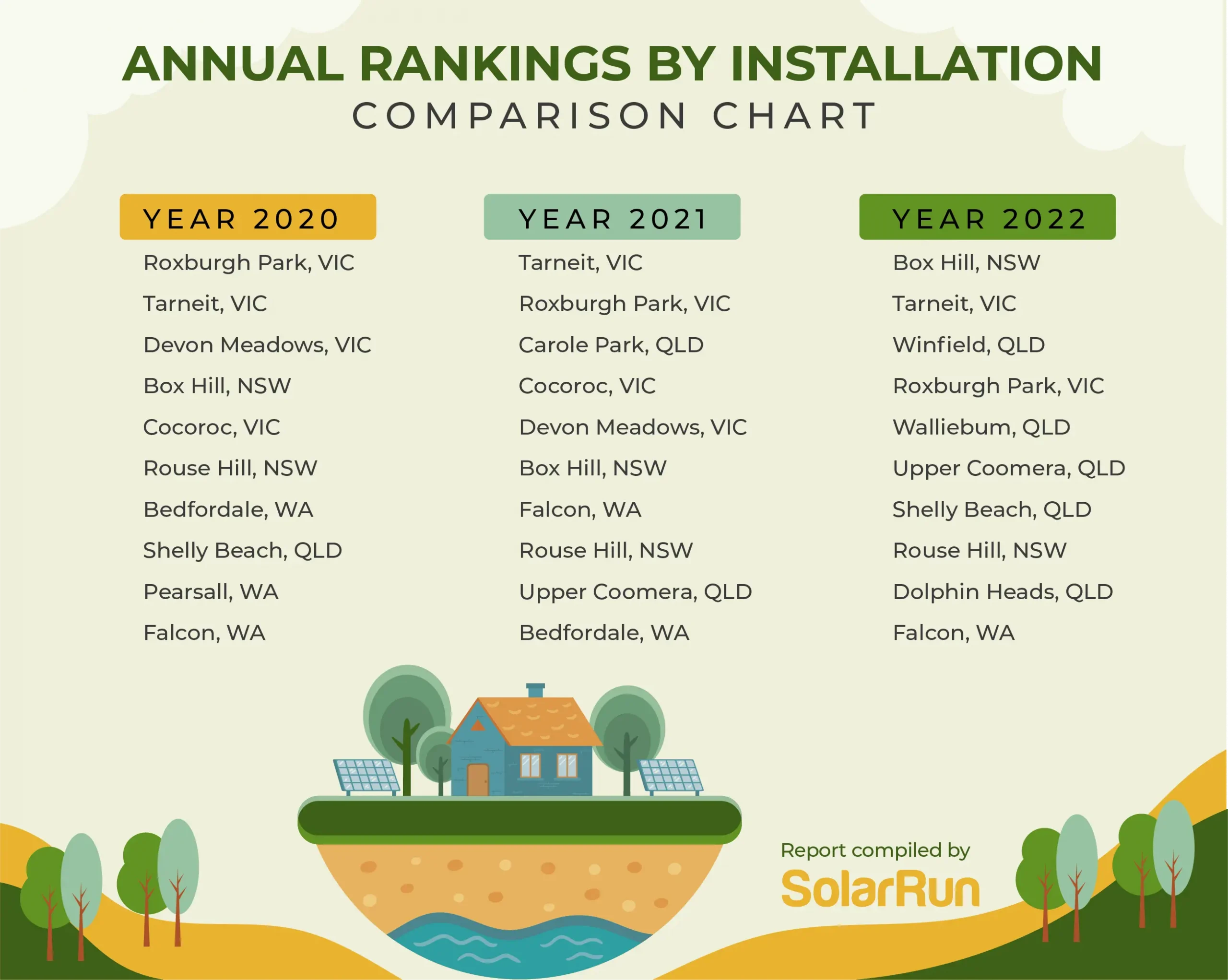

Starting in 2020, the push for renewable energy was strong, with Roxburgh Park in Victoria marking a high with 2,550 installations, followed closely by Tarneit with 2,501. As we moved into 2021, Tarneit took the lead with a remarkable 3,366 installations. In 2022, Box Hill, NSW dethroned Tarneit with a year-end total of 1,957 installations.

2023 saw Tarneit (2,177 installations) reclaim the top position from Box Hill (2,152 installations), docking the latter to #2. Not to be outdone, suburbs like Mackay in Queensland and Caloundra also showcased impressive numbers. In Queensland, Bundaberg stood out with 1,735 installations. Nearby, Caloundra and Mackay proved to be vanguards of the solar movement, recording 1,651 and 1,502 installations respectively. Other notable suburbs included Roxburgh Park in Victoria and Maryborough in Queensland with 1,475 and 1,466 installations respectively. Kellyville followed closely with 1,442 installations.

top 10 greenest suburbs in australia 2023

| Rank | State | Suburb | Jan-23 | Feb-23 | Mar-23 | Apr-23 | May-23 | Jun-23 | Jul-23 | Aug-23 | Sep-23 | Oct-23 | Nov-23 | Dec-23 | Total |

| 1 | VIC | Tarneit | 126 | 156 | 131 | 109 | 178 | 194 | 167 | 197 | 234 | 217 | 225 | 243 | 2177 |

| 2 | NSW | Box Hill | 97 | 152 | 155 | 115 | 133 | 161 | 205 | 213 | 209 | 210 | 226 | 276 | 2152 |

| 3 | QLD | Bundaberg | 95 | 149 | 148 | 121 | 197 | 162 | 146 | 144 | 150 | 146 | 140 | 137 | 1735 |

| 4 | QLD | Caloundra | 131 | 159 | 149 | 116 | 130 | 162 | 154 | 154 | 109 | 119 | 142 | 126 | 1651 |

| 5 | QLD | Mackay | 81 | 117 | 120 | 90 | 140 | 120 | 120 | 143 | 123 | 152 | 179 | 117 | 1502 |

| 6 | VIC | Roxburgh Park | 104 | 102 | 93 | 95 | 120 | 107 | 124 | 135 | 134 | 137 | 149 | 175 | 1475 |

| 7 | QLD | Maryborough | 130 | 134 | 129 | 107 | 120 | 108 | 111 | 144 | 126 | 114 | 115 | 128 | 1466 |

| 8 | NSW | Kellyville | 91 | 120 | 104 | 76 | 108 | 103 | 121 | 149 | 137 | 143 | 127 | 163 | 1442 |

| 9 | QLD | Toowoomba | 100 | 135 | 114 | 71 | 117 | 113 | 114 | 116 | 123 | 144 | 135 | 140 | 1422 |

| 10 | VIC | Werribee | 76 | 95 | 94 | 90 | 118 | 129 | 112 | 130 | 132 | 126 | 140 | 121 | 1363 |

| 1031 | 1319 | 1237 | 990 | 1361 | 1359 | 1374 | 1525 | 1477 | 1508 | 1578 | 1626 | 16385 |

| Rank | State | Suburb | Jan-22 | Feb-22 | Mar-22 | Apr-22 | May-22 | Jun-22 | Jul-22 | Aug-22 | Sep-22 | Oct-22 | Nov-22 | Dec-22 | Total |

| 1 | NSW | Box Hill | 182 | 149 | 125 | 117 | 131 | 181 | 142 | 229 | 163 | 140 | 191 | 207 | 1957 |

| 2 | VIC | Tarneit | 107 | 161 | 184 | 153 | 121 | 147 | 176 | 169 | 188 | 147 | 176 | 176 | 1905 |

| 3 | QLD | Bundaberg | 80 | 139 | 141 | 122 | 115 | 138 | 119 | 158 | 136 | 124 | 172 | 149 | 1593 |

| 4 | VIC | Roxburgh Park | 70 | 113 | 134 | 111 | 109 | 145 | 153 | 157 | 162 | 132 | 120 | 161 | 1567 |

| 5 | QLD | Maryborough | 82 | 124 | 126 | 91 | 101 | 107 | 134 | 136 | 134 | 120 | 140 | 119 | 1414 |

| 6 | QLD | Upper Coomera | 84 | 129 | 132 | 96 | 104 | 137 | 135 | 122 | 98 | 97 | 126 | 125 | 1385 |

| 7 | QLD | Caloundra | 85 | 86 | 120 | 89 | 95 | 118 | 121 | 138 | 118 | 120 | 145 | 137 | 1372 |

| 8 | NSW | Kellyville | 82 | 103 | 66 | 86 | 82 | 136 | 109 | 123 | 112 | 116 | 143 | 159 | 1317 |

| 9 | QLD | Mackay | 82 | 104 | 131 | 82 | 99 | 119 | 103 | 132 | 108 | 106 | 124 | 118 | 1308 |

| 10 | WA | Falcon | 85 | 98 | 130 | 91 | 124 | 96 | 88 | 127 | 131 | 84 | 133 | 115 | 1302 |

| 939 | 1206 | 1289 | 1038 | 1081 | 1324 | 1280 | 1491 | 1350 | 1186 | 1470 | 1466 | 15120 |

| Rank | State | Suburb | Jan-21 | Feb-21 | Mar-21 | Apr-21 | May-21 | Jun-21 | Jul-21 | Aug-21 | Sep-21 | Oct-21 | Nov-21 | Dec-21 | Total |

| 1 | VIC | Tarneit | 256 | 219 | 332 | 275 | 250 | 303 | 345 | 293 | 231 | 308 | 292 | 262 | 3366 |

| 2 | VIC | Roxburgh Park | 239 | 242 | 263 | 253 | 229 | 304 | 320 | 292 | 196 | 234 | 249 | 220 | 3041 |

| 3 | QLD | Carole Park | 197 | 294 | 331 | 316 | 271 | 225 | 208 | 211 | 185 | 134 | 116 | 126 | 2614 |

| 4 | VIC | Werribee | 187 | 181 | 229 | 177 | 164 | 200 | 231 | 177 | 105 | 163 | 144 | 125 | 2083 |

| 5 | VIC | Devon Meadows | 182 | 177 | 219 | 193 | 150 | 165 | 220 | 174 | 147 | 167 | 169 | 109 | 2072 |

| 6 | NSW | Box Hill | 161 | 185 | 210 | 177 | 134 | 170 | 121 | 66 | 198 | 176 | 196 | 214 | 2008 |

| 7 | WA | Falcon | 137 | 200 | 196 | 148 | 138 | 167 | 171 | 136 | 134 | 118 | 188 | 113 | 1846 |

| 8 | NSW | Kellyville | 158 | 209 | 170 | 156 | 136 | 126 | 95 | 104 | 142 | 149 | 132 | 146 | 1723 |

| 9 | QLD | Upper Coomera | 112 | 143 | 160 | 131 | 150 | 140 | 153 | 153 | 155 | 117 | 142 | 156 | 1712 |

| 10 | WA | Bedfordale | 137 | 127 | 155 | 146 | 136 | 106 | 124 | 174 | 126 | 114 | 128 | 154 | 1627 |

| 1766 | 1977 | 2265 | 1972 | 1758 | 1906 | 1988 | 1780 | 1619 | 1680 | 1756 | 1625 | 22092 | |||

| Rank | State | Suburb | Jan-20 | Feb-20 | Mar-20 | Apr-20 | May-20 | Jun-20 | Jul-20 | Aug-20 | Sep-20 | Oct-20 | Nov-20 | Dec-20 | Total |

| 1 | VIC | Roxburgh Park | 198 | 223 | 192 | 131 | 192 | 233 | 346 | 56 | 9 | 190 | 419 | 361 | 2550 |

| 2 | VIC | Tarneit | 270 | 262 | 199 | 149 | 181 | 196 | 242 | 56 | 9 | 169 | 421 | 347 | 2501 |

| 3 | VIC | Devon Meadows | 190 | 217 | 180 | 106 | 148 | 175 | 232 | 43 | 9 | 193 | 324 | 265 | 2082 |

| 4 | NSW | Box Hill | 103 | 105 | 127 | 88 | 148 | 142 | 168 | 167 | 209 | 222 | 236 | 211 | 1926 |

| 5 | VIC | Werribee | 182 | 185 | 150 | 117 | 131 | 166 | 191 | 40 | 4 | 109 | 290 | 251 | 1816 |

| 6 | NSW | Kellyville | 91 | 106 | 141 | 104 | 109 | 130 | 169 | 154 | 174 | 157 | 226 | 234 | 1795 |

| 7 | WA | Bedfordale | 99 | 127 | 124 | 90 | 106 | 180 | 147 | 170 | 195 | 205 | 172 | 177 | 1792 |

| 8 | QLD | Caloundra | 113 | 131 | 143 | 110 | 129 | 148 | 185 | 178 | 157 | 165 | 152 | 138 | 1749 |

| 9 | WA | Pearsall | 133 | 117 | 104 | 94 | 108 | 126 | 141 | 226 | 150 | 149 | 160 | 202 | 1710 |

| 10 | WA | Falcon | 93 | 107 | 169 | 142 | 92 | 121 | 130 | 138 | 157 | 205 | 153 | 176 | 1683 |

| 1472 | 1580 | 1529 | 1131 | 1344 | 1617 | 1951 | 1228 | 1073 | 1764 | 2553 | 2362 | 19604 |

From the four-year data, we observed:

annual rankings by installation comparison 2020 2022

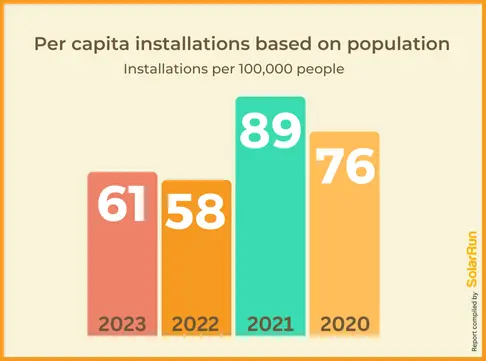

Going by the Top 10 totals, there was a higher rate of installations per capita in 2021 compared to other years. Here are the per capita installations for each year based on the population data:

average installations per capita

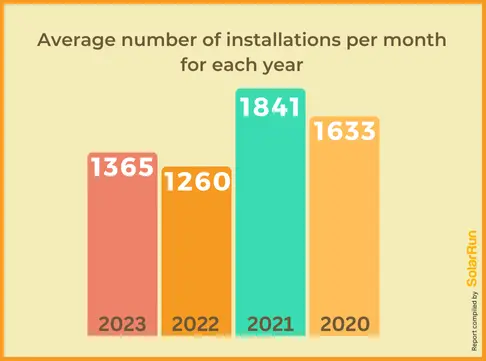

2021 had the highest monthly average, aligning with the per capita trend indicating a peak in renewable energy installations during that year. The average number of installations per month for each year is as follows:

average monthly installations

Solar installations appear to be higher in spring and summer compared to autumn and winter. This could be due to better weather conditions for installation during the warmer months and increased sunlight hours leading to greater perceived value for solar panels. Winter is also a popular time for installation because proactive homeowners wish to have their systems up and running by the time spring comes around. While there is some variation, overall solar installations seem to have decreased from 2021 to 2023. This could be owing to changes in government incentives or saturation in the market.

Seasonal installation between 2020 and 2023 was as follows:

average installation by seasons

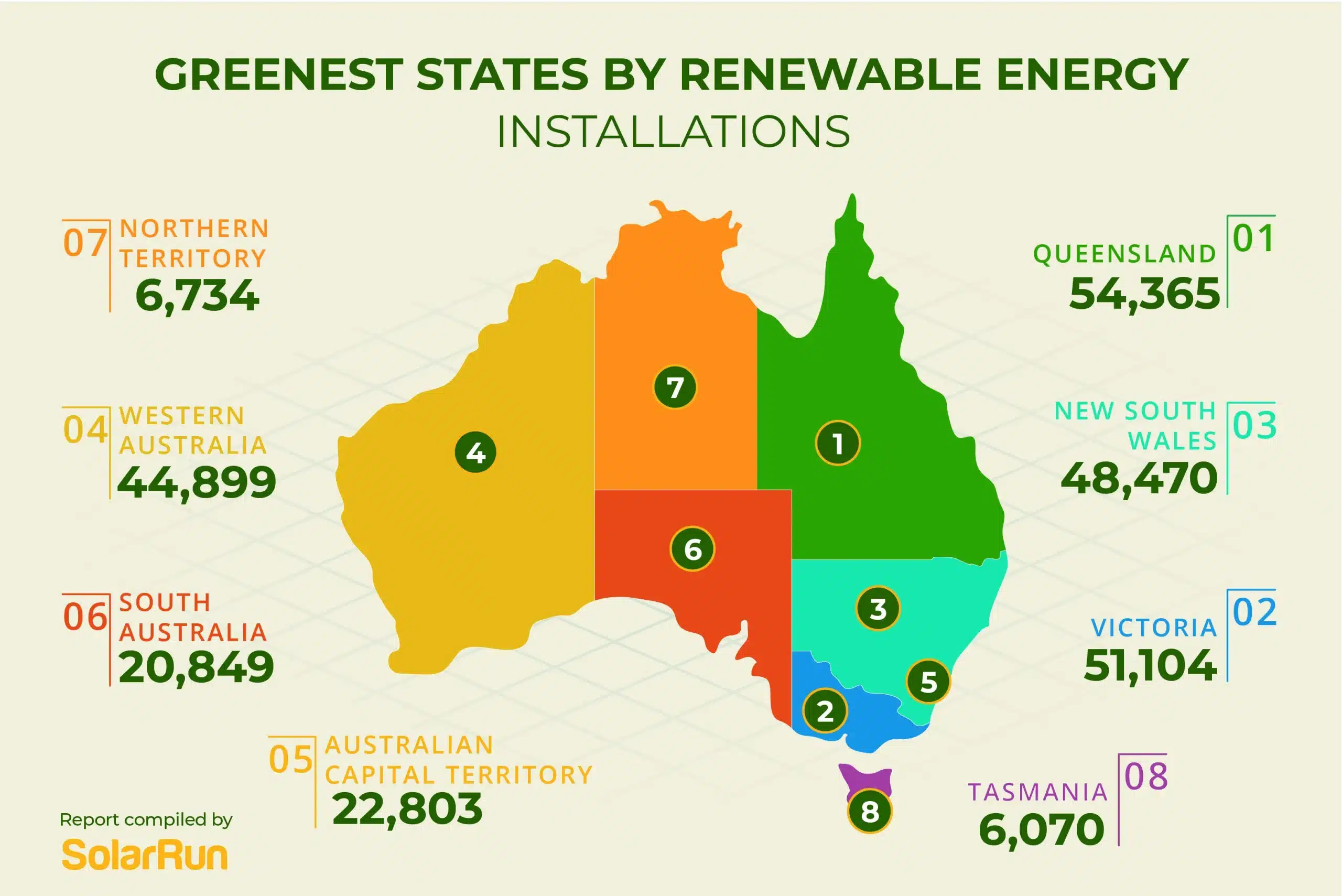

The distribution of installations varies across states because of geographic size, population density, availability and attractiveness of rebates, and community initiatives. You see higher installations in Victoria’s Tarneit and Roxburgh Park, NSW’s Box Hill, and Queensland’s Bundaberg owing to the new housing estates, denser population and smaller geographical areas of these states compared to other like Western Australia and Northern Territory, which see different trends due to their demographics and landscapes.

Queensland leads with the highest number of installations at 54,365. Victoria follows with 51,104 solar installations. New South Wales comes in third with 48,470 installations. Western Australia is next with a total of 44,899 installations. In fifth place is the Australian Capital Territory with 22,803 installations. South Australia follows with 20,849 installations. Second to last, we have Northern Territory with 6,734 installations. Rounding out the list is Tasmania with 6,070 installations.

Analysing the total renewable energy installations across Australian states from 2020 to 2023, combined with the contextual data on state areas and population, reveals interesting insights:

Victoria and Queensland, with populations of 6.8 million and 5.4 million respectively, lead in installations. Despite Victoria having the smallest area among the states, its total installations are impressive at 51,104, which means there is a high level of urban renewable energy integration. Queensland, with a larger area but a smaller population compared to Victoria, still leads with 54,365 installations, indicating aggressive renewable energy policies and possibly more space for larger projects.

Western Australia, the largest state by area, has a relatively lower population density (1.02 people per km²) and recorded 44,899 installations. Despite its vast area, the focus on renewable energy is considerable but not as intense per capita as in smaller but more densely populated states.

ACT, with the highest population density (171.4 people per km²) and the smallest area, shows a tremendous commitment to renewable energy with 22,803 installations. South Australia, though lagging behind the 786 times smaller ACT, has room for growth. Its lower figures could prompt state authorities and local governments to push for more attractive renewable energy policies.

States with lower population densities like NT and TAS have markedly fewer installations, at 6,734 and 6,070 respectively. These numbers reflect the challenges or perhaps lower urgency in spreading renewable energy infrastructure in less densely populated areas.

Conversely, states with moderate to high population densities such as NSW, VIC, and ACT show more robust installation figures, suggesting that higher population densities might drive bigger and better renewable energy initiatives.

The data suggests that states like Victoria, Queensland, and NSW are possibly leveraging their higher populations and economic activity to push for greater renewable energy adoption. This might be facilitated by both state-level policies and community initiatives oriented towards sustainability.

In contrast, the approach in vast but sparsely populated states like Western Australia and the Northern Territories may need to be different, focusing perhaps on community-specific projects or larger industrial installations that do not require dense population centres.

For future policymaking and planning, states with lower installation numbers but great potential (due to area or emerging economic growth) like Tasmania and Northern Territories might focus on targeted incentives to enhance renewable energy uptake.

The states with high installation numbers should continue to innovate and perhaps share best practices with less advanced states to promote a uniform national approach to renewable energy adoption.

total solar installations top 10 suburbs qld

| Rank | Suburb | Jan-23 | Feb-23 | Mar-23 | Apr-23 | May-23 | Jun-23 | Jul-23 | Aug-23 | Sep-23 | Oct-23 | Nov-23 | Dec-23 | Total |

| 1 | Bundaberg | 95 | 149 | 148 | 121 | 197 | 162 | 146 | 144 | 150 | 146 | 140 | 137 | 1735 |

| 2 | Caloundra | 131 | 159 | 149 | 116 | 130 | 162 | 154 | 154 | 109 | 119 | 142 | 126 | 1651 |

| 3 | Mackay | 81 | 117 | 120 | 90 | 140 | 120 | 120 | 143 | 123 | 152 | 179 | 117 | 1502 |

| 4 | Maryborough | 130 | 134 | 129 | 107 | 120 | 108 | 111 | 144 | 126 | 114 | 115 | 128 | 1466 |

| 5 | Toowoomba | 100 | 135 | 114 | 71 | 117 | 113 | 114 | 116 | 123 | 144 | 135 | 140 | 1422 |

| 6 | Yarrabilba | 89 | 110 | 106 | 84 | 120 | 119 | 99 | 107 | 112 | 88 | 100 | 84 | 1218 |

| 7 | Carole Park | 65 | 83 | 93 | 78 | 95 | 93 | 95 | 79 | 98 | 100 | 129 | 127 | 1135 |

| 8 | Mount Urah | 41 | 47 | 88 | 73 | 84 | 109 | 108 | 119 | 140 | 124 | 105 | 86 | 1124 |

| 9 | Upper Coomera | 81 | 109 | 97 | 68 | 79 | 87 | 90 | 91 | 85 | 91 | 91 | 80 | 1049 |

| 10 | Toolara Forest | 47 | 78 | 117 | 66 | 98 | 93 | 92 | 114 | 76 | 71 | 98 | 74 | 1024 |

| 860 | 1121 | 1161 | 874 | 1180 | 1166 | 1129 | 1211 | 1142 | 1149 | 1234 | 1099 | 13326 |

| Rank | Suburb | Jan-22 | Feb-22 | Mar-22 | Apr-22 | May-22 | Jun-22 | Jul-22 | Aug-22 | Sep-22 | Oct-22 | Nov-22 | Dec-22 | Total |

| 1 | Bundaberg | 80 | 139 | 141 | 122 | 115 | 138 | 119 | 158 | 136 | 124 | 172 | 149 | 1593 |

| 2 | Maryborough | 82 | 124 | 126 | 91 | 101 | 107 | 134 | 136 | 134 | 120 | 140 | 119 | 1414 |

| 3 | Upper Coomera | 84 | 129 | 132 | 96 | 104 | 137 | 135 | 122 | 98 | 97 | 126 | 125 | 1385 |

| 4 | Caloundra | 85 | 86 | 120 | 89 | 95 | 118 | 121 | 138 | 118 | 120 | 145 | 137 | 1372 |

| 5 | Mackay | 82 | 104 | 131 | 82 | 99 | 119 | 103 | 132 | 108 | 106 | 124 | 118 | 1308 |

| 6 | Toowoomba | 65 | 87 | 97 | 77 | 80 | 111 | 98 | 126 | 130 | 103 | 141 | 125 | 1240 |

| 7 | Yarrabilba | 69 | 77 | 101 | 106 | 71 | 121 | 99 | 127 | 112 | 82 | 129 | 118 | 1212 |

| 8 | Carole Park | 87 | 85 | 112 | 104 | 91 | 98 | 91 | 112 | 98 | 82 | 106 | 72 | 1138 |

| 9 | Toolara Forest | 42 | 81 | 92 | 83 | 42 | 78 | 74 | 94 | 82 | 59 | 93 | 82 | 902 |

| 10 | Mount Urah | 31 | 34 | 59 | 37 | 27 | 45 | 38 | 52 | 49 | 54 | 53 | 45 | 524 |

| 707 | 946 | 1111 | 887 | 825 | 1072 | 1012 | 1197 | 1065 | 947 | 1229 | 1090 | 12088 |

| Rank | Suburb | Jan-21 | Feb-21 | Mar-21 | Apr-21 | May-21 | Jun-21 | Jul-21 | Aug-21 | Sep-21 | Oct-21 | Nov-21 | Dec-21 | Total |

| 1 | Carole Park | 197 | 294 | 331 | 316 | 271 | 225 | 208 | 211 | 185 | 134 | 116 | 126 | 2614 |

| 2 | Upper Coomera | 112 | 143 | 160 | 131 | 150 | 140 | 153 | 153 | 155 | 117 | 142 | 156 | 1712 |

| 3 | Caloundra | 118 | 153 | 159 | 133 | 144 | 137 | 131 | 143 | 133 | 120 | 121 | 111 | 1603 |

| 4 | Bundaberg | 93 | 114 | 163 | 152 | 123 | 138 | 143 | 126 | 145 | 128 | 126 | 148 | 1599 |

| 5 | Maryborough | 91 | 128 | 154 | 144 | 129 | 144 | 121 | 122 | 130 | 111 | 130 | 122 | 1526 |

| 6 | Yarrabilba | 114 | 111 | 126 | 114 | 130 | 106 | 120 | 133 | 151 | 97 | 113 | 109 | 1424 |

| 7 | Mackay | 85 | 111 | 134 | 97 | 121 | 107 | 132 | 138 | 127 | 100 | 118 | 142 | 1412 |

| 8 | Toowoomba | 118 | 127 | 122 | 128 | 111 | 111 | 124 | 132 | 112 | 107 | 88 | 111 | 1391 |

| 9 | Toolara Forest | 64 | 83 | 94 | 84 | 89 | 98 | 92 | 108 | 87 | 76 | 86 | 107 | 1068 |

| 10 | Mount Urah | 39 | 48 | 65 | 47 | 32 | 37 | 48 | 39 | 57 | 42 | 51 | 46 | 551 |

| 1031 | 1312 | 1508 | 1346 | 1300 | 1243 | 1272 | 1305 | 1282 | 1032 | 1091 | 1178 | 14900 |

| Rank | Suburb | Jan-20 | Feb-20 | Mar-20 | Apr-20 | May-20 | Jun-20 | Jul-20 | Aug-20 | Sep-20 | Oct-20 | Nov-20 | Dec-20 | Total |

| 1 | Caloundra | 113 | 131 | 143 | 110 | 129 | 148 | 185 | 178 | 157 | 165 | 152 | 138 | 1749 |

| 2 | Bundaberg | 105 | 122 | 159 | 161 | 115 | 164 | 123 | 123 | 128 | 155 | 139 | 155 | 1649 |

| 3 | Carole Park | 117 | 113 | 150 | 108 | 104 | 135 | 148 | 167 | 153 | 156 | 119 | 171 | 1641 |

| 4 | Upper Coomera | 118 | 132 | 141 | 115 | 116 | 124 | 149 | 125 | 140 | 141 | 159 | 148 | 1608 |

| 5 | Maryborough | 120 | 125 | 123 | 138 | 106 | 111 | 129 | 146 | 172 | 130 | 144 | 120 | 1564 |

| 6 | Toowoomba | 77 | 102 | 115 | 104 | 106 | 124 | 128 | 118 | 134 | 156 | 116 | 124 | 1404 |

| 7 | Yarrabilba | 70 | 106 | 129 | 99 | 98 | 115 | 126 | 126 | 100 | 116 | 124 | 112 | 1321 |

| 8 | Mackay | 78 | 94 | 133 | 114 | 105 | 95 | 102 | 108 | 106 | 97 | 145 | 127 | 1304 |

| 9 | Toolara Forest | 90 | 91 | 89 | 95 | 97 | 95 | 106 | 103 | 117 | 93 | 106 | 103 | 1185 |

| 10 | Mount Urah | 38 | 49 | 59 | 49 | 45 | 49 | 46 | 45 | 47 | 68 | 73 | 58 | 626 |

| 926 | 1065 | 1241 | 1093 | 1021 | 1160 | 1242 | 1239 | 1254 | 1277 | 1277 | 1256 | 14051 |

Here are some trends observed in the solar installations across the top 10 suburbs in Queensland from 2020 to 2023:

The total number of installations across the top ten suburbs in Queensland between 2020 and 2023 is 54,365.

Suburbs like Bundaberg and Caloundra show a consistent presence in the top ranks over the years, indicating strong and sustained growth in solar installations.

Carole Park emerged as a leader in 2021 with the highest installations (2,614), suggesting a significant investment or initiative during that year.

Installation numbers fluctuate significantly from month to month and year to year in most suburbs, such as Upper Coomera and Mackay, which could be influenced by seasonal factors, promotional campaigns, or changes in local government incentives.

Some suburbs appear in the top 10 in certain years but not others. For instance, Mount Urah appears in the top 10 in 2020 but has lower rankings in subsequent years, indicating perhaps an initial surge followed by a plateau or decline in installation activities.

This trend of new entrants each year could reflect shifting focus areas for solar companies or changes in local policies that encourage installations in different suburbs.

There appears to be a trend of higher installations during the middle to the end of the year across several suburbs, possibly due to better weather conditions for installation or end-of-financial-year sales and incentives pushing for more installations.

Caloundra and Bundaberg maintain high installation numbers and rankings throughout the years, suggesting these areas might have favourable conditions or policies for solar energy, making them attractive for continuous growth in installations.

Queensland’s large geographic area (1,729,742 m2) and extensive coastline (13,352 km) are likely contributing factors to its high number of installations. The abundant sunshine (around 8–9 hours daily) makes solar energy a particularly effective choice.

The broad spread of installations, from Bundaberg at the high end to Toolara Forest at the lower end of the top ten, indicates a robust uptake of solar installations across diverse regions. Notably, all top ten suburbs, have installations exceeding 1,000, except five instances over four years.

The high sunshine hours (8–9 hours/day) directly correlate with the number of installations, which means that Queensland’s natural climate advantages are being effectively utilised to promote solar energy solutions.

The success of localised campaigns and the suitability of solar solutions in Queensland also suggest that regions with less developed traditional energy infrastructure are finding renewable energy to be a viable alternative. This is likely enhanced by state policies and incentives that promote solar energy adoption, especially in less densely populated areas.

The economic benefits of solar energy, combined with state incentives, are likely key drivers in the widespread adoption seen in Queensland. This is evident from the high engagement levels across the state, not just in metropolitan areas but also in more rural or remote locations.

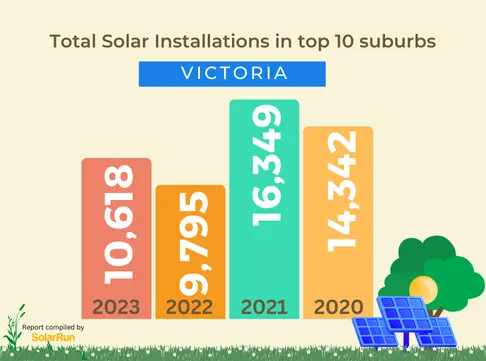

total solar installations top 10 suburbs vic

| Rank | Suburb | Jan-23 | Feb-23 | Mar-23 | Apr-23 | May-23 | Jun-23 | Jul-23 | Aug-23 | Sep-23 | Oct-23 | Nov-23 | Dec-23 | Total |

| 1 | Tarneit | 126 | 156 | 131 | 109 | 178 | 194 | 167 | 197 | 234 | 217 | 225 | 243 | 2177 |

| 2 | Roxburgh Park | 104 | 102 | 93 | 95 | 120 | 107 | 124 | 135 | 134 | 137 | 149 | 175 | 1475 |

| 3 | Werribee | 76 | 95 | 94 | 90 | 118 | 129 | 112 | 130 | 132 | 126 | 140 | 121 | 1363 |

| 4 | Devon Meadows | 109 | 106 | 102 | 91 | 145 | 121 | 110 | 121 | 103 | 108 | 124 | 122 | 1362 |

| 5 | Cardinia | 90 | 79 | 56 | 68 | 78 | 74 | 76 | 82 | 93 | 75 | 114 | 115 | 1000 |

| 6 | Lucas | 49 | 66 | 64 | 55 | 67 | 52 | 79 | 71 | 80 | 69 | 75 | 56 | 783 |

| 7 | Berwick | 46 | 71 | 46 | 54 | 47 | 46 | 41 | 58 | 35 | 59 | 80 | 66 | 649 |

| 8 | Pakenham | 29 | 57 | 39 | 42 | 70 | 46 | 47 | 63 | 55 | 56 | 56 | 76 | 636 |

| 9 | Mount Cottrell | 31 | 43 | 41 | 44 | 43 | 54 | 51 | 43 | 59 | 55 | 57 | 67 | 588 |

| 10 | Doreen | 36 | 57 | 33 | 33 | 45 | 43 | 68 | 57 | 53 | 53 | 55 | 52 | 585 |

| 696 | 832 | 699 | 681 | 911 | 866 | 875 | 957 | 978 | 955 | 1075 | 1093 | 10618 |

| Rank | Suburb | Jan-22 | Feb-22 | Mar-22 | Apr-22 | May-22 | Jun-22 | Jul-22 | Aug-22 | Sep-22 | Oct-22 | Nov-22 | Dec-22 | Total |

| 1 | Tarneit | 107 | 161 | 184 | 153 | 121 | 147 | 176 | 169 | 188 | 147 | 176 | 176 | 1905 |

| 2 | Roxburgh Park | 70 | 113 | 134 | 111 | 109 | 145 | 153 | 157 | 162 | 132 | 120 | 161 | 1567 |

| 3 | Werribee | 66 | 109 | 99 | 88 | 85 | 113 | 122 | 123 | 133 | 99 | 113 | 119 | 1269 |

| 4 | Devon Meadows | 55 | 91 | 104 | 75 | 100 | 109 | 111 | 119 | 142 | 120 | 112 | 126 | 1264 |

| 5 | Cardinia | 50 | 79 | 55 | 54 | 55 | 68 | 77 | 75 | 96 | 72 | 74 | 108 | 863 |

| 6 | Lucas | 25 | 45 | 60 | 53 | 50 | 43 | 49 | 58 | 59 | 49 | 78 | 64 | 633 |

| 7 | Doreen | 29 | 44 | 50 | 38 | 41 | 48 | 72 | 56 | 53 | 44 | 69 | 55 | 599 |

| 8 | Pakenham | 29 | 39 | 49 | 40 | 39 | 41 | 64 | 64 | 73 | 39 | 58 | 59 | 594 |

| 9 | Mount Cottrell | 39 | 45 | 53 | 44 | 26 | 39 | 47 | 45 | 49 | 35 | 53 | 49 | 524 |

| 10 | Berwick | 45 | 48 | 38 | 41 | 36 | 43 | 46 | 48 | 55 | 54 | 67 | 56 | 577 |

| 515 | 774 | 826 | 697 | 662 | 796 | 917 | 914 | 1010 | 791 | 920 | 973 | 9795 |

| Rank | Suburb | Jan-21 | Feb-21 | Mar-21 | Apr-21 | May-21 | Jun-21 | Jul-21 | Aug-21 | Sep-21 | Oct-21 | Nov-21 | Dec-21 | Total |

| 1 | Tarneit | 256 | 219 | 332 | 275 | 250 | 303 | 345 | 293 | 231 | 308 | 292 | 262 | 3366 |

| 2 | Roxburgh Park | 239 | 242 | 263 | 253 | 229 | 304 | 320 | 292 | 196 | 234 | 249 | 220 | 3041 |

| 3 | Werribee | 187 | 181 | 229 | 177 | 164 | 200 | 231 | 177 | 105 | 163 | 144 | 125 | 2083 |

| 4 | Devon Meadows | 182 | 177 | 219 | 193 | 150 | 165 | 220 | 174 | 147 | 167 | 169 | 109 | 2072 |

| 5 | Cardinia | 111 | 132 | 152 | 109 | 103 | 129 | 129 | 128 | 87 | 133 | 128 | 103 | 1444 |

| 6 | Berwick | 67 | 115 | 88 | 67 | 68 | 79 | 92 | 75 | 59 | 61 | 86 | 73 | 930 |

| 7 | Mount Cottrell | 63 | 81 | 83 | 92 | 73 | 55 | 111 | 87 | 56 | 69 | 80 | 63 | 913 |

| 8 | Doreen | 104 | 87 | 82 | 96 | 66 | 70 | 76 | 70 | 50 | 64 | 67 | 54 | 886 |

| 9 | Pakenham | 63 | 85 | 85 | 62 | 61 | 72 | 104 | 83 | 49 | 76 | 66 | 57 | 863 |

| 10 | Lucas | 49 | 67 | 66 | 58 | 56 | 71 | 66 | 54 | 60 | 53 | 86 | 65 | 751 |

| 1321 | 1386 | 1599 | 1382 | 1220 | 1448 | 1694 | 1433 | 1040 | 1328 | 1367 | 1131 | 16349 |

| Rank | Suburb | Jan-20 | Feb-20 | Mar-20 | Apr-20 | May-20 | Jun-20 | Jul-20 | Aug-20 | Sep-20 | Oct-20 | Nov-20 | Dec-20 | Total |

| 1 | Roxburgh Park | 198 | 223 | 192 | 131 | 192 | 233 | 346 | 56 | 9 | 190 | 419 | 361 | 2550 |

| 2 | Tarneit | 270 | 262 | 199 | 149 | 181 | 196 | 242 | 56 | 9 | 169 | 421 | 347 | 2501 |

| 3 | Devon Meadows | 190 | 217 | 180 | 106 | 148 | 175 | 232 | 43 | 9 | 193 | 324 | 265 | 2082 |

| 4 | Werribee | 182 | 185 | 150 | 117 | 131 | 166 | 191 | 40 | 4 | 109 | 290 | 251 | 1816 |

| 5 | Cardinia | 171 | 145 | 118 | 81 | 105 | 126 | 165 | 34 | 10 | 113 | 231 | 184 | 1483 |

| 6 | Doreen | 67 | 97 | 72 | 62 | 54 | 81 | 101 | 19 | 3 | 86 | 147 | 128 | 917 |

| 7 | Mount Cottrell | 67 | 77 | 52 | 35 | 54 | 75 | 81 | 17 | 3 | 48 | 146 | 107 | 762 |

| 8 | Berwick | 63 | 50 | 62 | 43 | 54 | 59 | 82 | 20 | 6 | 53 | 129 | 128 | 749 |

| 9 | Lucas | 53 | 59 | 78 | 44 | 66 | 54 | 78 | 58 | 76 | 55 | 58 | 64 | 743 |

| 10 | Pakenham | 56 | 67 | 76 | 31 | 53 | 56 | 105 | 22 | 3 | 53 | 126 | 91 | 739 |

| 1317 | 1382 | 1179 | 799 | 1038 | 1221 | 1623 | 365 | 132 | 1069 | 2291 | 1926 | 14342 |

Based on the data provided for the top 10 suburbs in Victoria from 2020 to 2023, here are some trends and observations regarding solar installations:

The total number of installations across the top ten suburbs in Victoria between 2020 and 2023 is 51,104.

A general increase in total annual installations can be observed, especially in suburbs like Tarneit and Roxburgh Park. This could indicate growing acceptance and adoption of solar technology due to increasing awareness, government incentives, or rising electricity costs.

Suburbs such as Tarneit and Roxburgh Park consistently appear at the top of the list across the years. This consistency could be attributed to demographic factors, economic growth, or local government policies supporting renewable energy.

Installations generally peak during the later months of the year (October to December). This trend could be driven by end-of-year promotions, better weather for installations, or consumers acting on new budget cycles.

Some suburbs show more fluctuation in installation numbers year by year, such as Devon Meadows and Cardinia. These variations could be influenced by local developments, changes in the availability of installers, or varying levels of promotional activities.

The pronounced drop in installation numbers from Tarneit to Eynesbury in 2023 indicates that the adoption of solar installations is concentrated in specific areas.

There is an observable increase in the total installations from 2020 to 2023 across almost all suburbs. This overall growth trend reflects a robust move towards solar energy, likely driven by both state and federal incentives, as well as a growing cultural shift towards sustainable living.

Newer or rapidly developing suburbs like Werribee and Doreen are showing impressive numbers of installations. This indicates that newer residential developments are incorporating solar installations as a standard feature of new 7-star NatHERS homes.

Victoria, with a population of 6.8 million and an area of 227,444 km², has a population density of 26.11 people per km². This higher density, compared to more sparsely populated states, influences the placement and adoption of solar installations, particularly in suburban areas.

Victoria’s and Australia’s leading suburb, Tarneit, highlights the effectiveness of state policies and market conditions that particularly support renewable energy initiatives. This could be due to targeted subsidies, comprehensive urban planning policies, or community-led renewable energy projects.

Despite the high urban density, Victoria has managed to implement a high number of renewable energy solutions. This means the state is proactive in overcoming urban constraints like limited space and high property density.

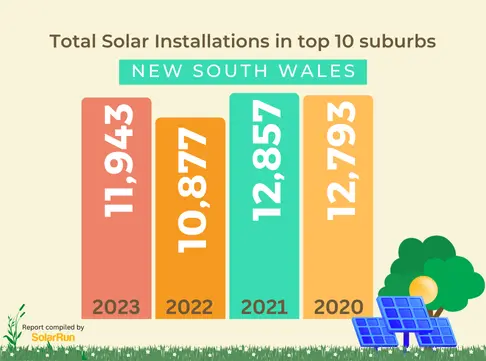

total solar installations top 10 suburbs nsw

| Rank | Suburb | Jan-23 | Feb-23 | Mar-23 | Apr-23 | May-23 | Jun-23 | Jul-23 | Aug-23 | Sep-23 | Oct-23 | Nov-23 | Dec-23 | Total |

| 1 | Box Hill | 97 | 152 | 155 | 115 | 133 | 161 | 205 | 213 | 209 | 210 | 226 | 276 | 2152 |

| 2 | Kellyville | 91 | 120 | 104 | 76 | 108 | 103 | 121 | 149 | 137 | 143 | 127 | 163 | 1442 |

| 3 | Jilliby | 93 | 114 | 103 | 79 | 117 | 90 | 86 | 100 | 105 | 119 | 110 | 102 | 1218 |

| 4 | Camden | 60 | 90 | 85 | 68 | 97 | 98 | 139 | 125 | 98 | 107 | 120 | 113 | 1200 |

| 5 | Liverpool | 60 | 70 | 81 | 63 | 91 | 96 | 103 | 112 | 127 | 117 | 99 | 112 | 1131 |

| 6 | Campbelltown | 83 | 80 | 99 | 65 | 85 | 80 | 95 | 106 | 92 | 77 | 108 | 105 | 1075 |

| 7 | Baulkham Hills | 43 | 83 | 60 | 58 | 64 | 85 | 89 | 94 | 118 | 97 | 95 | 105 | 991 |

| 8 | Port Macquarie | 44 | 69 | 70 | 56 | 93 | 102 | 86 | 78 | 94 | 81 | 101 | 86 | 960 |

| 9 | Vincentia | 52 | 63 | 72 | 60 | 84 | 89 | 78 | 82 | 86 | 78 | 80 | 70 | 894 |

| 10 | Central Coast | 46 | 71 | 78 | 80 | 80 | 52 | 76 | 80 | 70 | 64 | 95 | 88 | 880 |

| 669 | 912 | 907 | 720 | 952 | 956 | 1078 | 1139 | 1136 | 1093 | 1161 | 1220 | 11943 |

| Rank | Suburb | Jan-22 | Feb-22 | Mar-22 | Apr-22 | May-22 | Jun-22 | Jul-22 | Aug-22 | Sep-22 | Oct-22 | Nov-22 | Dec-22 | Total |

| 1 | Box Hill | 182 | 149 | 125 | 117 | 131 | 181 | 142 | 229 | 163 | 140 | 191 | 207 | 1957 |

| 2 | Kellyville | 82 | 103 | 66 | 86 | 82 | 136 | 109 | 123 | 112 | 116 | 143 | 159 | 1317 |

| 3 | Camden | 59 | 81 | 79 | 73 | 71 | 150 | 93 | 125 | 105 | 121 | 117 | 122 | 1196 |

| 4 | Jilliby | 60 | 82 | 72 | 72 | 99 | 89 | 99 | 115 | 79 | 89 | 140 | 131 | 1127 |

| 5 | Campbelltown | 73 | 105 | 80 | 48 | 63 | 102 | 93 | 107 | 79 | 80 | 98 | 113 | 1041 |

| 6 | Vincentia | 45 | 71 | 60 | 64 | 76 | 83 | 74 | 102 | 84 | 84 | 118 | 99 | 960 |

| 7 | Liverpool | 57 | 61 | 64 | 51 | 71 | 105 | 77 | 97 | 70 | 76 | 105 | 107 | 941 |

| 8 | Port Macquarie | 26 | 61 | 61 | 55 | 57 | 55 | 86 | 119 | 85 | 76 | 106 | 120 | 907 |

| 9 | Baulkham Hills | 36 | 48 | 37 | 44 | 43 | 65 | 54 | 87 | 68 | 60 | 83 | 91 | 716 |

| 10 | Central Coast | 38 | 58 | 51 | 51 | 53 | 52 | 53 | 72 | 59 | 74 | 86 | 68 | 715 |

| 658 | 819 | 695 | 661 | 746 | 1018 | 880 | 1176 | 904 | 916 | 1187 | 1217 | 10877 |

| Rank | Suburb | Jan-21 | Feb-21 | Mar-21 | Apr-21 | May-21 | Jun-21 | Jul-21 | Aug-21 | Sep-21 | Oct-21 | Nov-21 | Dec-21 | Total |

| 1 | Box Hill | 161 | 185 | 210 | 177 | 134 | 170 | 121 | 66 | 198 | 176 | 196 | 214 | 2008 |

| 2 | Kellyville | 158 | 209 | 170 | 156 | 136 | 126 | 95 | 104 | 142 | 149 | 132 | 146 | 1723 |

| 3 | Camden | 137 | 135 | 147 | 129 | 85 | 102 | 85 | 99 | 123 | 103 | 103 | 135 | 1383 |

| 4 | Campbelltown | 113 | 116 | 133 | 192 | 124 | 143 | 91 | 24 | 121 | 92 | 74 | 99 | 1322 |

| 5 | Jilliby | 76 | 113 | 116 | 152 | 103 | 90 | 73 | 108 | 97 | 92 | 96 | 110 | 1226 |

| 6 | Liverpool | 114 | 119 | 124 | 114 | 115 | 133 | 91 | 25 | 99 | 85 | 89 | 83 | 1191 |

| 7 | Vincentia | 80 | 120 | 117 | 125 | 82 | 70 | 93 | 90 | 85 | 90 | 102 | 121 | 1175 |

| 8 | Baulkham Hills | 75 | 123 | 106 | 92 | 65 | 66 | 46 | 33 | 78 | 64 | 105 | 118 | 971 |

| 9 | Port Macquarie | 71 | 105 | 94 | 59 | 78 | 88 | 95 | 75 | 83 | 80 | 90 | 78 | 996 |

| 10 | Central Coast | 63 | 91 | 106 | 76 | 86 | 68 | 30 | 79 | 52 | 66 | 68 | 77 | 862 |

| 1048 | 1316 | 1323 | 1272 | 1008 | 1056 | 820 | 703 | 1078 | 997 | 1055 | 1181 | 12857 |

| Rank | Suburb | Jan-20 | Feb-20 | Mar-20 | Apr-20 | May-20 | Jun-20 | Jul-20 | Aug-20 | Sep-20 | Oct-20 | Nov-20 | Dec-20 | Total |

| 1 | Box Hill | 103 | 105 | 127 | 88 | 148 | 142 | 168 | 167 | 209 | 222 | 236 | 211 | 1926 |

| 2 | Kellyville | 91 | 106 | 141 | 104 | 109 | 130 | 169 | 154 | 174 | 157 | 226 | 234 | 1795 |

| 3 | Camden | 62 | 94 | 91 | 103 | 97 | 111 | 124 | 154 | 130 | 118 | 142 | 130 | 1356 |

| 4 | Campbelltown | 92 | 99 | 105 | 63 | 70 | 99 | 148 | 122 | 158 | 104 | 123 | 125 | 1308 |

| 5 | Port Macquarie | 89 | 135 | 116 | 102 | 119 | 90 | 96 | 90 | 127 | 110 | 102 | 117 | 1293 |

| 6 | Liverpool | 83 | 96 | 58 | 75 | 58 | 123 | 107 | 108 | 122 | 115 | 130 | 152 | 1227 |

| 7 | Jilliby | 74 | 65 | 86 | 96 | 82 | 76 | 90 | 110 | 130 | 96 | 121 | 113 | 1139 |

| 8 | Vincentia | 72 | 70 | 74 | 76 | 91 | 90 | 97 | 91 | 111 | 92 | 112 | 72 | 1048 |

| 9 | Baulkham Hills | 50 | 61 | 72 | 64 | 56 | 61 | 65 | 75 | 83 | 81 | 104 | 110 | 882 |

| 10 | Central Coast | 55 | 55 | 59 | 47 | 55 | 60 | 73 | 77 | 85 | 72 | 96 | 85 | 819 |

| 771 | 886 | 929 | 818 | 885 | 982 | 1137 | 1148 | 1329 | 1167 | 1392 | 1349 | 12793 |

Based on the data provided for the top 10 suburbs in New South Wales from 2020 to 2023, here are some observed trends regarding solar installations:

The total number of installations across the top ten suburbs in New South Wales between 2020 and 2023 is 48,470.

Suburbs like Box Hill show a consistent increase in installations year over year, reaching a peak in 2023, which suggests a growing residential or commercial development conducive to solar installations.

Conversely, some suburbs like Camden show fluctuations with no clear upward or downward trend, indicating varying economic or regulatory impacts over the years.

NSW’s approach to solar installations showcases a more gradual decrease from the highest to the lowest in the top ten suburbs compared to Victoria (2023). This suggests a widespread acceptance and integration of solar technology across a variety of suburban settings within the state.

There is a noticeable increase in installations during the later months of each year (from September to December), likely due to better weather conditions for installation or year-end financial incentives driving consumer behaviour.

Suburbs such as Box Hill and Kellyville consistently appear in the top ranks across the years. Their unwavering presence suggests robust local policies supporting solar energy, or these areas may have more new constructions that incorporate solar technology.

Total installations across the top 10 suburbs tend to increase each year, which could reflect broader state-wide initiatives to promote solar energy, improvements in solar technology making it more accessible, or increasing public awareness and acceptance of solar power as a viable energy source.

Suburbs with large year-to-year variations in installation numbers might be experiencing significant changes such as housing developments, changes in local government incentives, or economic fluctuations impacting consumer investment capabilities.

With a population of 8.3 million and an area of 801,150 km², NSW has a population density of 9.52 people per km². This relatively high density influences the adoption and implementation of solar installations, especially in urban areas where space may be limited.

The high number of installations in suburbs like Box Hill indicates that state policies and market conditions are likely favourable for renewable energy projects. This is supported by NSW’s focus on integrating solar solutions in urban areas where traditional roof installations might be less feasible due to space constraints.

Compared to Victoria, NSW has shown a higher per-suburb penetration of solar installations. This could be due to more aggressive renewable energy policies in NSW or a higher level of community engagement and awareness within the state.

The urban dynamics of NSW, particularly in Sydney and surrounding suburbs, present challenges such as fewer homeowners, limited roof space, lower sunshine hours (6–8/day), and a high number of rental properties. These factors might limit the feasibility of large-scale solar installations, pushing the focus towards smaller, more integrated solar solutions.

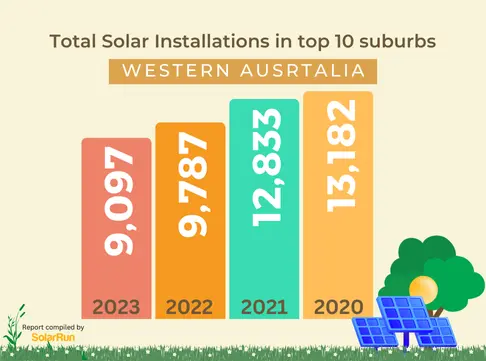

total solar installations top 10 suburbs wa

| Rank | Suburb | Jan-23 | Feb-23 | Mar-23 | Apr-23 | May-23 | Jun-23 | Jul-23 | Aug-23 | Sep-23 | Oct-23 | Nov-23 | Dec-23 | Total |

| 1 | Falcon | 88 | 125 | 128 | 76 | 104 | 92 | 93 | 131 | 130 | 103 | 99 | 134 | 1303 |

| 2 | Bedfordale | 89 | 128 | 93 | 83 | 85 | 103 | 95 | 95 | 87 | 181 | 132 | 130 | 1301 |

| 3 | Aubin Grove | 82 | 108 | 95 | 81 | 77 | 95 | 82 | 65 | 83 | 108 | 88 | 78 | 1042 |

| 4 | Pearsall | 65 | 67 | 113 | 79 | 69 | 43 | 85 | 91 | 56 | 95 | 140 | 78 | 981 |

| 5 | Henley Brook | 70 | 66 | 64 | 78 | 66 | 49 | 60 | 92 | 83 | 66 | 85 | 116 | 895 |

| 6 | Aveley | 60 | 69 | 59 | 105 | 69 | 37 | 56 | 88 | 60 | 52 | 114 | 95 | 864 |

| 7 | Baldivis | 84 | 66 | 66 | 48 | 70 | 77 | 57 | 78 | 78 | 66 | 46 | 60 | 796 |

| 8 | Bibra Lake | 60 | 85 | 63 | 44 | 54 | 46 | 54 | 49 | 50 | 53 | 57 | 55 | 670 |

| 9 | Huntingdale | 42 | 48 | 37 | 24 | 58 | 60 | 63 | 50 | 34 | 87 | 73 | 59 | 635 |

| 10 | Willetton | 34 | 56 | 46 | 34 | 49 | 43 | 44 | 56 | 42 | 62 | 63 | 81 | 610 |

| 674 | 818 | 764 | 652 | 701 | 645 | 689 | 795 | 703 | 873 | 897 | 886 | 9097 |

| Rank | Suburb | Jan-22 | Feb-22 | Mar-22 | Apr-22 | May-22 | Jun-22 | Jul-22 | Aug-22 | Sep-22 | Oct-22 | Nov-22 | Dec-22 | Total |

| 1 | Falcon | 85 | 98 | 130 | 91 | 124 | 96 | 88 | 127 | 131 | 84 | 133 | 115 | 1302 |

| 2 | Bedfordale | 117 | 116 | 106 | 97 | 145 | 106 | 101 | 92 | 125 | 102 | 88 | 106 | 1301 |

| 3 | Pearsall | 58 | 126 | 146 | 85 | 88 | 102 | 78 | 91 | 80 | 94 | 191 | 97 | 1236 |

| 4 | Aubin Grove | 95 | 94 | 123 | 64 | 105 | 83 | 63 | 104 | 116 | 101 | 91 | 93 | 1132 |

| 5 | Aveley | 62 | 64 | 136 | 58 | 69 | 51 | 116 | 78 | 64 | 59 | 119 | 118 | 994 |

| 6 | Henley Brook | 74 | 61 | 96 | 72 | 52 | 75 | 69 | 84 | 42 | 75 | 88 | 113 | 901 |

| 7 | Baldivis | 51 | 77 | 77 | 92 | 71 | 55 | 58 | 84 | 86 | 53 | 66 | 78 | 848 |

| 8 | Bibra Lake | 43 | 75 | 70 | 52 | 58 | 68 | 51 | 70 | 65 | 82 | 57 | 84 | 775 |

| 9 | Willetton | 62 | 56 | 74 | 42 | 56 | 44 | 58 | 50 | 58 | 54 | 73 | 70 | 697 |

| 10 | Huntingdale | 41 | 45 | 54 | 41 | 39 | 47 | 50 | 37 | 61 | 73 | 58 | 55 | 601 |

| 688 | 812 | 1012 | 694 | 807 | 727 | 732 | 817 | 828 | 777 | 964 | 929 | 9787 |

| Rank | Suburb | Jan-21 | Feb-21 | Mar-21 | Apr-21 | May-21 | Jun-21 | Jul-21 | Aug-21 | Sep-21 | Oct-21 | Nov-21 | Dec-21 | Total |

| 1 | Falcon | 137 | 200 | 196 | 148 | 138 | 167 | 171 | 136 | 134 | 118 | 188 | 113 | 1846 |

| 2 | Bedfordale | 137 | 127 | 155 | 146 | 136 | 106 | 124 | 174 | 126 | 114 | 128 | 154 | 1627 |

| 3 | Pearsall | 113 | 111 | 145 | 135 | 174 | 152 | 101 | 101 | 132 | 165 | 156 | 140 | 1625 |

| 4 | Aubin Grove | 126 | 125 | 187 | 153 | 125 | 115 | 133 | 151 | 109 | 95 | 132 | 164 | 1615 |

| 5 | Willetton | 104 | 103 | 105 | 92 | 99 | 88 | 103 | 89 | 88 | 89 | 88 | 86 | 1134 |

| 6 | Aveley | 103 | 83 | 102 | 64 | 76 | 121 | 80 | 96 | 76 | 153 | 88 | 75 | 1117 |

| 7 | Henley Brook | 100 | 86 | 87 | 76 | 81 | 121 | 81 | 117 | 83 | 75 | 72 | 71 | 1050 |

| 8 | Baldivis | 112 | 67 | 85 | 81 | 81 | 83 | 108 | 85 | 72 | 70 | 97 | 90 | 1031 |

| 9 | Bibra Lake | 64 | 67 | 92 | 78 | 77 | 78 | 62 | 78 | 70 | 75 | 87 | 81 | 909 |

| 10 | Huntingdale | 62 | 87 | 99 | 85 | 71 | 80 | 59 | 62 | 68 | 71 | 78 | 57 | 879 |

| 1058 | 1056 | 1253 | 1058 | 1058 | 1111 | 1022 | 1089 | 958 | 1025 | 1114 | 1031 | 12833 |

| Rank | Suburb | Jan-20 | Feb-20 | Mar-20 | Apr-20 | May-20 | Jun-20 | Jul-20 | Aug-20 | Sep-20 | Oct-20 | Nov-20 | Dec-20 | Total |

| 1 | Bedfordale | 99 | 127 | 124 | 90 | 106 | 180 | 147 | 170 | 195 | 205 | 172 | 177 | 1792 |

| 2 | Pearsall | 133 | 117 | 104 | 94 | 108 | 126 | 141 | 226 | 150 | 149 | 160 | 202 | 1710 |

| 3 | Falcon | 93 | 107 | 169 | 142 | 92 | 121 | 130 | 138 | 157 | 205 | 153 | 176 | 1683 |

| 4 | Aubin Grove | 84 | 117 | 117 | 99 | 113 | 116 | 120 | 132 | 151 | 211 | 149 | 151 | 1560 |

| 5 | Aveley | 73 | 135 | 120 | 88 | 65 | 88 | 99 | 137 | 113 | 107 | 76 | 140 | 1241 |

| 6 | Willetton | 70 | 75 | 77 | 71 | 64 | 109 | 122 | 85 | 93 | 142 | 152 | 146 | 1206 |

| 7 | Henley Brook | 81 | 122 | 95 | 66 | 64 | 91 | 93 | 98 | 112 | 100 | 76 | 104 | 1102 |

| 8 | Baldivis | 56 | 64 | 77 | 114 | 65 | 70 | 62 | 73 | 137 | 101 | 70 | 116 | 1005 |

| 9 | Bibra Lake | 66 | 54 | 66 | 78 | 64 | 65 | 124 | 68 | 89 | 97 | 92 | 91 | 954 |

| 10 | Huntingdale | 58 | 69 | 74 | 41 | 54 | 80 | 82 | 90 | 97 | 104 | 87 | 93 | 929 |

| 813 | 987 | 1023 | 883 | 795 | 1046 | 1120 | 1217 | 1294 | 1421 | 1187 | 1396 | 13182 |

From the data provided for the top 10 suburbs in Western Australia regarding solar installations from 2020 to 2023, here are some key trends observed:

The total number of installations across the top ten suburbs in Western Australia between 2020 and 2023 is 44,899.

Some suburbs, such as Falcon and Bedfordale, show a consistent growth in solar installations over the years. This could be indicative of an increasing local interest in renewable energy solutions, possibly driven by community initiatives or state incentives. These efforts likely capitalise on the ample space available for large-scale installations, such as solar farms, which are more feasible in less densely populated areas.

The installation numbers across most suburbs exhibit variability from month to month within each year, with certain periods (typically the warmer months) seeing higher installation rates. This trend is possibly related to more favourable weather conditions for installations.

The spread of installations from Falcon to Willetton (2023) suggests that solar energy uptake is not uniformly distributed but is high in certain communities. This pattern may reflect the challenges and opportunities of deploying renewable energy solutions across large, sparsely populated areas.

Certain months, such as December and January, generally show higher installation numbers across multiple years. This could be due to end-of-year promotions, financial year tax incentives, or simply more suitable installation conditions during the summer months.

While some suburbs show growth, others like Aubin Grove and Henley Brook show fluctuations without a clear upward trend, suggesting that local factors or changes in market dynamics might significantly impact solar adoption rates.

Suburbs like Falcon and Bedfordale not only show growth but also have some of the highest total installations in certain years, highlighting them as hotspots for solar energy adoption in Western Australia.

The total volume of installations across these top suburbs has generally increased from 2020 to 2023, suggesting a growing market for solar in the region, aligned with broader trends in Australia towards renewable energy solutions.

Western Australia, with a sprawling area of 2,527,013 km² and a relatively modest population of 2.9 million, has a very low population density of 1.02 people per km². This vast area combined with low density affects the strategy and feasibility of widespread residential solar installation networks.

Western Australia’s higher per capita installations compared to more densely populated states indicate successful localised campaigns and possibly state-level incentives that make solar installations attractive and viable even in remote or rural settings.

The state’s high average sunshine hours (8–9 hours daily) drive the adoption of solar energy. This consistent solar exposure makes it an ideal region for maximising the efficiency of solar panels, which in turn enhance the return on investment in solar technology.

Given Western Australia’s geographic characteristics, there is tremendous potential to expand solar energy projects, especially large-scale installations that can generate substantial amounts of renewable energy. Such developments could meet local energy demands and contribute to the state’s energy grid stability and sustainability.

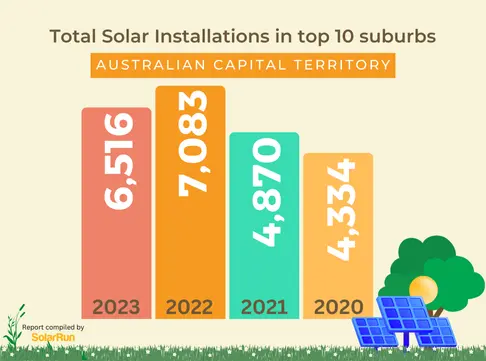

total solar installations top 10 suburbs act

| Rank | Suburb | Jan-23 | Feb-23 | Mar-23 | Apr-23 | May-23 | Jun-23 | Jul-23 | Aug-23 | Sep-23 | Oct-23 | Nov-23 | Dec-23 | Total |

| 1 | MacGregor | 74 | 109 | 104 | 92 | 115 | 80 | 106 | 85 | 76 | 99 | 82 | 64 | 1086 |

| 2 | Fisher | 68 | 94 | 97 | 78 | 91 | 87 | 106 | 112 | 114 | 70 | 70 | 61 | 1048 |

| 3 | Nicholls | 54 | 77 | 112 | 86 | 80 | 74 | 86 | 104 | 78 | 68 | 63 | 75 | 957 |

| 4 | Forde | 34 | 67 | 59 | 51 | 43 | 57 | 72 | 63 | 52 | 46 | 45 | 42 | 631 |

| 5 | Downer | 56 | 69 | 46 | 38 | 45 | 33 | 41 | 56 | 53 | 40 | 39 | 38 | 554 |

| 6 | Calwell ACT | 49 | 73 | 57 | 43 | 47 | 52 | 54 | 50 | 55 | 43 | 45 | 22 | 590 |

| 7 | Bruce | 37 | 38 | 67 | 40 | 51 | 42 | 43 | 49 | 35 | 61 | 20 | 37 | 520 |

| 8 | Kambah | 32 | 41 | 30 | 35 | 40 | 37 | 44 | 29 | 29 | 26 | 20 | 23 | 386 |

| 9 | Banks | 33 | 52 | 41 | 35 | 27 | 32 | 36 | 27 | 33 | 22 | 25 | 13 | 376 |

| 10 | Cook | 32 | 30 | 34 | 27 | 47 | 32 | 35 | 27 | 29 | 28 | 27 | 20 | 368 |

| 469 | 650 | 647 | 525 | 586 | 526 | 623 | 602 | 554 | 503 | 436 | 395 | 6516 |

| Rank | Suburb | Jan-22 | Feb-22 | Mar-22 | Apr-22 | May-22 | Jun-22 | Jul-22 | Aug-22 | Sep-22 | Oct-22 | Nov-22 | Dec-22 | Total |

| 1 | MacGregor | 77 | 103 | 109 | 73 | 96 | 112 | 105 | 110 | 126 | 119 | 136 | 118 | 1284 |

| 2 | Nicholls | 65 | 71 | 76 | 50 | 81 | 90 | 84 | 87 | 78 | 107 | 117 | 101 | 1007 |

| 3 | Fisher | 48 | 68 | 85 | 47 | 67 | 66 | 77 | 83 | 67 | 89 | 114 | 122 | 933 |

| 4 | Forde | 53 | 67 | 72 | 54 | 57 | 63 | 63 | 74 | 72 | 44 | 75 | 81 | 775 |

| 5 | Calwell ACT | 34 | 50 | 48 | 38 | 47 | 53 | 73 | 102 | 65 | 54 | 91 | 84 | 739 |

| 6 | Downer | 36 | 33 | 44 | 30 | 43 | 42 | 27 | 48 | 49 | 43 | 48 | 63 | 506 |

| 7 | Bruce | 27 | 48 | 50 | 27 | 43 | 56 | 41 | 39 | 115 | 56 | 56 | 44 | 602 |

| 8 | Banks | 25 | 39 | 42 | 24 | 33 | 26 | 34 | 43 | 53 | 43 | 43 | 48 | 453 |

| 9 | Cook | 26 | 37 | 40 | 41 | 43 | 35 | 33 | 38 | 40 | 25 | 37 | 29 | 424 |

| 10 | Kambah | 18 | 28 | 18 | 22 | 19 | 29 | 38 | 32 | 36 | 35 | 46 | 39 | 360 |

| 409 | 544 | 584 | 406 | 529 | 572 | 575 | 656 | 701 | 615 | 763 | 729 | 7083 |

| Rank | Suburb | Jan-21 | Feb-21 | Mar-21 | Apr-21 | May-21 | Jun-21 | Jul-21 | Aug-21 | Sep-21 | Oct-21 | Nov-21 | Dec-21 | Total |

| 1 | MacGregor | 53 | 57 | 84 | 84 | 76 | 76 | 64 | 42 | 106 | 85 | 91 | 116 | 934 |

| 2 | Nicholls | 29 | 44 | 42 | 54 | 50 | 45 | 67 | 33 | 68 | 62 | 85 | 90 | 669 |

| 3 | Fisher | 44 | 49 | 37 | 42 | 49 | 57 | 45 | 28 | 64 | 63 | 86 | 104 | 668 |

| 4 | Forde | 28 | 51 | 41 | 36 | 33 | 36 | 46 | 23 | 51 | 34 | 69 | 73 | 521 |

| 5 | Calwell ACT | 36 | 40 | 42 | 26 | 34 | 27 | 41 | 21 | 46 | 43 | 52 | 59 | 467 |

| 6 | Downer | 29 | 29 | 44 | 34 | 33 | 31 | 29 | 21 | 18 | 32 | 50 | 37 | 387 |

| 7 | Bruce | 20 | 37 | 33 | 28 | 40 | 35 | 29 | 16 | 26 | 21 | 55 | 46 | 386 |

| 8 | Banks | 29 | 27 | 21 | 25 | 24 | 20 | 31 | 16 | 30 | 22 | 31 | 21 | 297 |

| 9 | Cook | 23 | 30 | 28 | 19 | 26 | 18 | 33 | 21 | 25 | 23 | 20 | 28 | 294 |

| 10 | Kambah | 16 | 22 | 21 | 23 | 20 | 21 | 18 | 7 | 17 | 20 | 32 | 30 | 247 |

| 307 | 386 | 393 | 371 | 385 | 366 | 403 | 228 | 451 | 405 | 571 | 604 | 4870 |

| Rank | Suburb | Jan-20 | Feb-20 | Mar-20 | Apr-20 | May-20 | Jun-20 | Jul-20 | Aug-20 | Sep-20 | Oct-20 | Nov-20 | Dec-20 | Total |

| 1 | MacGregor | 32 | 48 | 56 | 60 | 56 | 68 | 77 | 87 | 80 | 84 | 95 | 74 | 817 |

| 2 | Forde | 24 | 24 | 42 | 34 | 31 | 38 | 61 | 56 | 64 | 61 | 58 | 76 | 569 |

| 3 | Fisher | 30 | 32 | 34 | 33 | 54 | 47 | 52 | 42 | 58 | 54 | 49 | 66 | 551 |

| 4 | Nicholls | 26 | 33 | 32 | 20 | 39 | 30 | 66 | 65 | 53 | 62 | 54 | 62 | 542 |

| 5 | Calwell ACT | 29 | 25 | 31 | 17 | 23 | 33 | 53 | 47 | 54 | 29 | 37 | 44 | 422 |

| 6 | Bruce | 20 | 24 | 37 | 13 | 34 | 23 | 32 | 31 | 31 | 41 | 34 | 50 | 370 |

| 7 | Downer | 17 | 19 | 17 | 20 | 31 | 25 | 37 | 32 | 27 | 27 | 33 | 39 | 324 |

| 8 | Banks | 12 | 23 | 18 | 17 | 13 | 18 | 18 | 26 | 19 | 26 | 32 | 41 | 263 |

| 9 | Cook | 10 | 14 | 14 | 10 | 31 | 20 | 30 | 24 | 22 | 22 | 34 | 27 | 258 |

| 10 | Kambah | 14 | 16 | 9 | 10 | 16 | 27 | 18 | 17 | 18 | 25 | 21 | 27 | 218 |

| 214 | 258 | 290 | 234 | 328 | 329 | 444 | 427 | 426 | 431 | 447 | 506 | 4334 |

Based on the data provided for the top 10 suburbs in the Australian Capital Territory (ACT) regarding solar installations from 2020 to 2023, here are some trends and insights:

The total number of installations across the top ten suburbs in the Australian Capital Territory between 2020 and 2023 is 22,803.

There is a high density of installations in ACT, relative to its population size.

There is a noticeable overall increase in solar installations over the years, particularly in suburbs like MacGregor and Fisher, which suggests growing acceptance and adoption of solar technology within the community. This could be due to increased local government incentives or a rising awareness of renewable energy benefits.

The installation numbers exhibit some variability across different months and years, with peaks typically occurring towards the end and beginning of the year. This pattern could be influenced by seasonal promotions, end-of-year incentives, or more favourable installation conditions during certain times of the year.

MacGregor consistently shows high installation numbers. This could indicate favourable socio-economic conditions, community initiatives, or local policies promoting solar energy use. Some suburbs like Nicholls and Calwell show fluctuations in their yearly totals but indicate a gradual increase over the years, suggesting slow but steady adoption rates that could accelerate with ongoing support and awareness campaigns.

Suburbs with lower total installations may be facing lower socio-economic conditions, less homeowner stability, or geographical limitations that could affect solar uptake. Targeted initiatives could help overcome these barriers.

A common trend across most suburbs is an increase in installations towards the year’s end, possibly driven by residents trying to capitalise on rebates and tax incentives offered for renewable energy installations.

ACT, with its compact area of 2,358 km² and a population of 465,000, has a high population density of 171.4 people per km². This density is a core factor that influences the strategy for deploying renewable energy installations in urban settings where space might be limited.

Although ACT is the smallest state, it has managed to be ahead of South Australia (417x its size), Northern Territory (572x its size), and Tasmania (29x its size). The spread of installations in ACT shows a robust integration of solar technology into urban residential areas, which is important in densely populated regions. The high per capita installations show that ACT’s renewable energy promotion endeavours in smaller, urbanised areas are successful.

ACT’s government has set ambitious targets for green infrastructure, including increasing canopy cover and promoting renewable energy, which align with its high rate of solar installations. These initiatives increase sustainability, improve liveability, and reduce environmental impact.

With 8–10 average daily hours of sunshine, ACT is well-positioned to take advantage of solar energy. The state’s consistent sunshine exposure can maximise the efficiency of solar installations, making solar energy a cost-effective and sustainable option to meet the community’s energy needs.

total solar installations top 10 suburbs sa

| Rank | Suburb | Jan-23 | Feb-23 | Mar-23 | Apr-23 | May-23 | Jun-23 | Jul-23 | Aug-23 | Sep-23 | Oct-23 | Nov-23 | Dec-23 | Total |

| 1 | Wistow | 29 | 51 | 57 | 33 | 63 | 48 | 44 | 59 | 54 | 40 | 40 | 39 | 557 |

| 2 | Andrews Farm | 51 | 59 | 62 | 46 | 38 | 38 | 50 | 39 | 46 | 42 | 51 | 31 | 553 |

| 3 | Woodcraft | 38 | 60 | 41 | 44 | 39 | 38 | 46 | 45 | 33 | 60 | 46 | 50 | 540 |

| 4 | Flagstaff Hill | 44 | 47 | 40 | 43 | 30 | 29 | 49 | 43 | 42 | 47 | 57 | 40 | 511 |

| 5 | Salisbury Downs | 29 | 47 | 46 | 25 | 55 | 52 | 64 | 45 | 42 | 35 | 36 | 34 | 510 |

| 6 | Moana | 29 | 27 | 26 | 32 | 48 | 39 | 45 | 42 | 33 | 29 | 35 | 47 | 432 |

| 7 | Mawson Lakes | 35 | 33 | 30 | 24 | 32 | 31 | 47 | 34 | 32 | 26 | 54 | 37 | 415 |

| 8 | Hallett Cove | 29 | 32 | 28 | 18 | 37 | 24 | 52 | 38 | 30 | 28 | 45 | 27 | 388 |

| 9 | Cromer | 28 | 26 | 24 | 31 | 11 | 27 | 26 | 31 | 40 | 56 | 52 | 29 | 381 |

| 10 | Bibaringa | 26 | 37 | 37 | 28 | 27 | 23 | 27 | 48 | 31 | 30 | 35 | 24 | 373 |

| 338 | 419 | 391 | 324 | 380 | 349 | 450 | 424 | 383 | 393 | 451 | 358 | 4660 |

| Rank | Suburb | Jan-22 | Feb-22 | Mar-22 | Apr-22 | May-22 | Jun-22 | Jul-22 | Aug-22 | Sep-22 | Oct-22 | Nov-22 | Dec-22 | Total |

| 1 | Andrews Farm | 41 | 53 | 67 | 47 | 54 | 49 | 55 | 67 | 68 | 62 | 68 | 61 | 692 |

| 2 | Woodcraft | 32 | 41 | 55 | 33 | 42 | 46 | 48 | 46 | 58 | 55 | 60 | 83 | 599 |

| 3 | Salisbury Downs | 31 | 49 | 47 | 40 | 60 | 60 | 58 | 43 | 59 | 36 | 50 | 50 | 583 |

| 4 | Wistow | 31 | 42 | 44 | 30 | 52 | 28 | 40 | 55 | 39 | 31 | 52 | 70 | 514 |

| 5 | Flagstaff Hill | 29 | 37 | 41 | 33 | 46 | 40 | 53 | 47 | 38 | 44 | 56 | 44 | 508 |

| 6 | Mawson Lakes | 32 | 25 | 33 | 18 | 35 | 36 | 47 | 46 | 44 | 35 | 58 | 33 | 442 |

| 7 | Moana | 26 | 27 | 36 | 28 | 30 | 38 | 41 | 40 | 32 | 34 | 42 | 50 | 424 |

| 8 | Bibaringa | 17 | 37 | 36 | 33 | 36 | 45 | 34 | 22 | 34 | 35 | 45 | 35 | 409 |

| 9 | Hallett Cove | 20 | 40 | 23 | 22 | 25 | 33 | 38 | 43 | 26 | 26 | 40 | 38 | 374 |

| 10 | Cromer | 17 | 28 | 33 | 19 | 35 | 28 | 29 | 34 | 20 | 40 | 34 | 39 | 356 |

| 276 | 379 | 415 | 303 | 415 | 403 | 443 | 443 | 418 | 398 | 505 | 503 | 4901 |

| Rank | Suburb | Jan-21 | Feb-21 | Mar-21 | Apr-21 | May-21 | Jun-21 | Jul-21 | Aug-21 | Sep-21 | Oct-21 | Nov-21 | Dec-21 | Total |

| 1 | Salisbury Downs | 57 | 62 | 69 | 53 | 57 | 55 | 47 | 77 | 62 | 61 | 50 | 54 | 704 |

| 2 | Andrews Farm | 56 | 61 | 59 | 55 | 50 | 45 | 43 | 65 | 57 | 42 | 61 | 51 | 645 |

| 3 | Wistow | 31 | 45 | 64 | 59 | 41 | 37 | 36 | 63 | 58 | 51 | 62 | 63 | 610 |

| 4 | Woodcraft | 47 | 51 | 61 | 36 | 41 | 41 | 47 | 62 | 58 | 52 | 55 | 33 | 584 |

| 5 | Flagstaff Hill | 49 | 46 | 46 | 43 | 43 | 33 | 39 | 56 | 53 | 41 | 51 | 54 | 554 |

| 6 | Moana | 34 | 34 | 49 | 33 | 36 | 39 | 42 | 75 | 61 | 40 | 40 | 51 | 534 |

| 7 | Mawson Lakes | 45 | 38 | 50 | 36 | 45 | 32 | 31 | 37 | 44 | 52 | 45 | 46 | 501 |

| 8 | Bibaringa | 34 | 45 | 53 | 30 | 25 | 28 | 33 | 36 | 39 | 37 | 35 | 36 | 431 |

| 9 | Hallett Cove | 31 | 47 | 49 | 25 | 21 | 32 | 28 | 40 | 34 | 36 | 22 | 34 | 399 |

| 10 | Cromer | 19 | 30 | 19 | 22 | 20 | 22 | 30 | 45 | 40 | 21 | 44 | 36 | 348 |

| 403 | 459 | 519 | 392 | 379 | 364 | 376 | 556 | 506 | 433 | 465 | 458 | 5310 |

| Rank | Suburb | Jan-20 | Feb-20 | Mar-20 | Apr-20 | May-20 | Jun-20 | Jul-20 | Aug-20 | Sep-20 | Oct-20 | Nov-20 | Dec-20 | Total |

| 1 | Andrews Farm | 60 | 74 | 65 | 62 | 73 | 66 | 86 | 81 | 91 | 72 | 59 | 72 | 861 |

| 2 | Salisbury Downs | 42 | 71 | 82 | 53 | 54 | 72 | 94 | 76 | 84 | 73 | 58 | 64 | 823 |

| 3 | Flagstaff Hill | 44 | 60 | 64 | 56 | 47 | 41 | 43 | 51 | 85 | 55 | 64 | 48 | 658 |

| 4 | Woodcraft | 37 | 48 | 49 | 53 | 42 | 42 | 56 | 70 | 56 | 66 | 70 | 56 | 645 |

| 5 | Wistow | 44 | 50 | 58 | 34 | 40 | 39 | 62 | 53 | 68 | 44 | 45 | 53 | 590 |

| 6 | Moana | 34 | 36 | 46 | 39 | 40 | 44 | 55 | 63 | 69 | 41 | 50 | 52 | 569 |

| 7 | Mawson Lakes | 34 | 41 | 41 | 43 | 41 | 50 | 68 | 45 | 51 | 46 | 54 | 50 | 564 |

| 8 | Hallett Cove | 32 | 41 | 42 | 34 | 35 | 35 | 46 | 44 | 49 | 36 | 47 | 44 | 485 |

| 9 | Bibaringa | 18 | 34 | 36 | 35 | 59 | 37 | 34 | 35 | 53 | 30 | 34 | 38 | 443 |

| 10 | Cromer | 26 | 23 | 25 | 23 | 29 | 25 | 27 | 29 | 48 | 28 | 30 | 27 | 340 |

| 371 | 478 | 508 | 432 | 460 | 451 | 571 | 547 | 654 | 491 | 511 | 504 | 5978 |

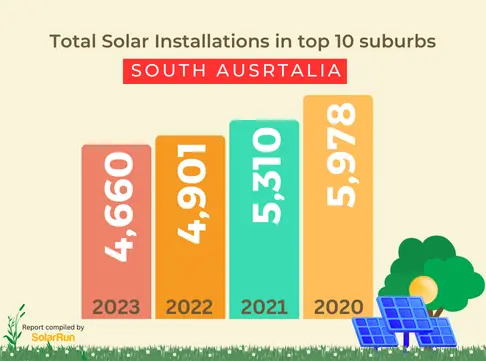

Based on the data provided for the top 10 suburbs in South Australia regarding solar installations from 2020 to 2023, here are some key observations and trends:

The total number of installations across the top ten suburbs in South Australia between 2020 and 2023 is 20,849.

Several suburbs such as Andrews Farm and Salisbury Downs have shown consistent growth or stability in solar installations over the years. This consistency likely reflects positive community responses to solar initiatives and ongoing local investments in renewable energy.

There are noticeable fluctuations in monthly installation numbers across the years for most suburbs. This variability could be influenced by seasonal factors, financial incentives, or changes in local government policies related to solar energy.

A common trend across multiple suburbs is an increase in installations towards the end of the year. This pattern may be due to residents taking advantage of year-end rebates and incentives, or simply more favourable weather conditions for installations during these months.

Suburbs like Wistow and Moana, while not always leading in total numbers, have shown tremendous growth rates, suggesting that solar uptake is becoming more widespread across different areas of South Australia.

The growth in installations in suburbs such as Woodcroft and Flagstaff Hill may reflect effective local policies promoting renewable energy, which suggests that the government’s efforts to influence solar adoption are successful in these areas. However, the modest number of installations in suburbs such as Wistow and Andrews Farm suggests that renewable energy projects in other South Australian communities may be driven more by local initiatives and community-led projects rather than widespread state-level campaigns. This is reflected in the concentrated pockets of higher installation numbers within certain suburbs.

The total number of installations in the top 10 suburbs has increased over the years, indicating a broader acceptance and integration of solar technology within the state.

South Australia, with an extensive area of 984,321 km² and a population of 1.8 million, has a low population density of 1.73 people per km². This low density impacts the distribution and feasibility of widespread solar installation networks across the state.

Given the large geographic area and the relatively sparse population distribution, South Australia faces unique challenges in implementing widespread renewable energy solutions. However, these same factors also offer opportunities for large-scale solar farms and other renewable projects that can operate efficiently in less densely populated areas.

Despite having fewer installations than the eastern states, the renewable energy adoption in leading suburbs indicates a high regional interest in renewable energy, which could be bolstered by state policies and incentives designed to increase renewable energy uptake.

With an average of 6 to 8 daily hours of sunshine, South Australia is well-positioned to utilise solar energy effectively. The consistent sunshine ensures efficiency and viability for solar energy projects.

total solar installations top 10 suburbs nt

| Rank | Suburb | Jan-23 | Feb-23 | Mar-23 | Apr-23 | May-23 | Jun-23 | Jul-23 | Aug-23 | Sep-23 | Oct-23 | Nov-23 | Dec-23 | Total |

| 1 | Mitchell | 15 | 19 | 23 | 13 | 13 | 10 | 19 | 15 | 19 | 19 | 24 | 20 | 209 |

| 2 | Nightcliff | 14 | 23 | 11 | 19 | 8 | 10 | 12 | 20 | 22 | 15 | 29 | 21 | 204 |

| 3 | Moulden | 12 | 11 | 13 | 10 | 8 | 7 | 8 | 14 | 11 | 12 | 11 | 12 | 129 |

| 4 | Marrara | 8 | 9 | 15 | 5 | 7 | 10 | 6 | 8 | 5 | 11 | 8 | 11 | 103 |

| 5 | Charles Darwin | 10 | 6 | 15 | 4 | 7 | 9 | 7 | 9 | 8 | 10 | 10 | 6 | 101 |

| 6 | White Gums | 6 | 3 | 8 | 11 | 12 | 19 | 7 | 13 | 3 | 8 | 3 | 7 | 100 |

| 7 | Rum Jungle | 1 | 6 | 6 | 5 | 6 | 8 | 6 | 11 | 9 | 5 | 15 | 5 | 83 |

| 8 | Girraween | 2 | 8 | 4 | 6 | 4 | 4 | 5 | 3 | 3 | 5 | 7 | 8 | 59 |

| 9 | Knuckey Lagoon | 3 | 5 | 8 | 5 | 3 | 3 | 2 | 6 | 5 | 5 | 9 | 4 | 58 |

| 10 | Katherine | 0 | 0 | 0 | 0 | 9 | 12 | 18 | 2 | 0 | 1 | 6 | 0 | 48 |

| 71 | 90 | 103 | 78 | 77 | 92 | 90 | 101 | 85 | 91 | 122 | 94 | 1094 |

| Rank | Suburb | Jan-22 | Feb-22 | Mar-22 | Apr-22 | May-22 | Jun-22 | Jul-22 | Aug-22 | Sep-22 | Oct-22 | Nov-22 | Dec-22 | Total |

| 1 | Nightcliff | 7 | 18 | 21 | 23 | 22 | 22 | 15 | 25 | 24 | 34 | 40 | 28 | 279 |

| 2 | Mitchell | 12 | 15 | 32 | 19 | 19 | 29 | 25 | 15 | 18 | 34 | 35 | 20 | 273 |

| 3 | Moulden | 8 | 13 | 19 | 13 | 18 | 15 | 13 | 9 | 14 | 17 | 18 | 14 | 171 |

| 4 | Marrara | 9 | 13 | 14 | 8 | 7 | 11 | 12 | 9 | 15 | 22 | 19 | 16 | 155 |

| 5 | Rum Jungle | 2 | 10 | 11 | 7 | 11 | 12 | 21 | 8 | 16 | 6 | 8 | 11 | 123 |

| 6 | Girraween | 1 | 9 | 20 | 13 | 11 | 10 | 9 | 10 | 7 | 11 | 11 | 4 | 116 |

| 7 | White Gums | 2 | 7 | 15 | 11 | 6 | 17 | 6 | 9 | 11 | 10 | 10 | 10 | 114 |

| 8 | Charles Darwin | 2 | 5 | 15 | 10 | 9 | 7 | 8 | 14 | 12 | 13 | 9 | 6 | 110 |

| 9 | Katherine | 0 | 1 | 9 | 3 | 8 | 7 | 3 | 9 | 1 | 16 | 24 | 1 | 82 |

| 10 | Knuckey Lagoon | 2 | 4 | 2 | 1 | 9 | 2 | 2 | 6 | 1 | 4 | 6 | 8 | 47 |

| 45 | 95 | 158 | 108 | 120 | 132 | 114 | 114 | 119 | 167 | 180 | 118 | 1470 |

| Rank | Suburb | Jan-21 | Feb-21 | Mar-21 | Apr-21 | May-21 | Jun-21 | Jul-21 | Aug-21 | Sep-21 | Oct-21 | Nov-21 | Dec-21 | Total |

| 1 | Mitchell | 23 | 27 | 23 | 11 | 19 | 24 | 27 | 21 | 22 | 33 | 37 | 24 | 291 |

| 2 | Nightcliff | 11 | 21 | 32 | 15 | 25 | 16 | 22 | 16 | 14 | 32 | 23 | 24 | 251 |

| 3 | White Gums | 4 | 11 | 15 | 13 | 22 | 26 | 33 | 17 | 12 | 27 | 13 | 24 | 217 |

| 4 | Moulden | 16 | 22 | 15 | 4 | 14 | 11 | 12 | 10 | 16 | 21 | 20 | 22 | 183 |

| 5 | Marrara | 15 | 17 | 10 | 11 | 16 | 7 | 16 | 9 | 7 | 9 | 19 | 15 | 151 |

| 6 | Charles Darwin | 6 | 14 | 14 | 9 | 8 | 13 | 15 | 9 | 9 | 15 | 11 | 10 | 133 |

| 7 | Rum Jungle | 6 | 5 | 7 | 7 | 11 | 7 | 6 | 6 | 10 | 10 | 16 | 15 | 106 |

| 8 | Girraween | 4 | 10 | 9 | 5 | 7 | 5 | 5 | 7 | 7 | 8 | 16 | 13 | 96 |

| 9 | Katherine | 1 | 1 | 0 | 1 | 6 | 7 | 13 | 4 | 22 | 11 | 1 | 4 | 71 |

| 10 | Knuckey Lagoon | 1 | 9 | 9 | 8 | 4 | 7 | 6 | 2 | 3 | 2 | 4 | 6 | 61 |

| 87 | 137 | 134 | 84 | 132 | 123 | 155 | 101 | 122 | 168 | 160 | 157 | 1560 |

| Rank | Suburb | Jan-20 | Feb-20 | Mar-20 | Apr-20 | May-20 | Jun-20 | Jul-20 | Aug-20 | Sep-20 | Oct-20 | Nov-20 | Dec-20 | Total |

| 1 | Nightcliff | 55 | 69 | 53 | 43 | 61 | 60 | 50 | 44 | 36 | 20 | 34 | 31 | 556 |

| 2 | Mitchell | 42 | 40 | 32 | 38 | 47 | 33 | 32 | 27 | 19 | 18 | 29 | 19 | 376 |

| 3 | Marrara | 30 | 46 | 31 | 42 | 50 | 35 | 27 | 30 | 20 | 17 | 19 | 15 | 362 |

| 4 | Moulden | 27 | 31 | 42 | 42 | 41 | 26 | 27 | 16 | 19 | 19 | 29 | 23 | 342 |

| 5 | White Gums | 18 | 21 | 31 | 14 | 34 | 19 | 23 | 17 | 26 | 14 | 13 | 21 | 251 |

| 6 | Charles Darwin | 21 | 29 | 14 | 25 | 32 | 30 | 31 | 17 | 17 | 15 | 9 | 10 | 250 |

| 7 | Girraween | 21 | 21 | 23 | 19 | 22 | 19 | 21 | 19 | 12 | 11 | 5 | 2 | 195 |

| 8 | Rum Jungle | 13 | 18 | 15 | 13 | 18 | 20 | 11 | 5 | 23 | 25 | 8 | 18 | 187 |

| 9 | Knuckey Lagoon | 3 | 10 | 4 | 5 | 6 | 3 | 5 | 2 | 4 | 2 | 4 | 8 | 56 |

| 10 | Katherine | 5 | 2 | 1 | 1 | 6 | 3 | 0 | 6 | 2 | 2 | 4 | 3 | 35 |

| 235 | 287 | 246 | 242 | 317 | 248 | 227 | 183 | 178 | 143 | 154 | 150 | 2610 |

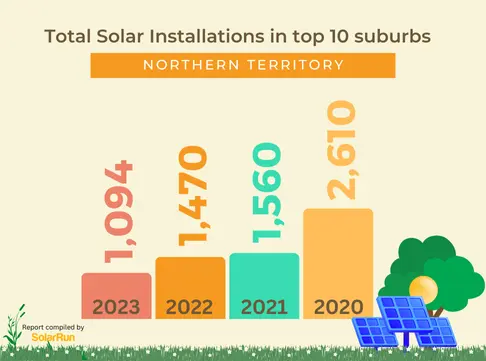

Based on the data provided for the top 10 suburbs in the Northern Territory regarding solar installations from 2020 to 2023, here are some key observations and trends:

The total number of installations across the top ten suburbs in Northern Territory between 2020 and 2023 is 6,734.

Suburbs such as Mitchell and Nightcliff show a consistent increase in solar installations over the years. This gradual increase could be indicative of growing awareness and acceptance of solar energy solutions within these communities.

There is intense variability in installation numbers across different suburbs, with some like Nightcliff and Mitchell consistently ranking high, whereas others like Knuckey Lagoon and Katherine have very few installations. This suggests that geographic, demographic, or socio-economic factors might be influencing solar adoption rates.

The installation numbers exhibit some seasonal variability, with many suburbs showing peaks at certain times of the year, potentially due to weather conditions being favourable for installations or end-of-year financial incentives.

Smaller suburbs such as Girraween and Rum Jungle show fewer installations but maintain a presence in the top 10, which may indicate niche community initiatives or targeted local government support.

A recurring trend is a peak in installations towards the end of the year across several suburbs. This could be driven by residents trying to capitalise on rebates and tax incentives offered for renewable energy installations before year-end.

The Northern Territory, with an expansive area of 1,347,791 km² and a modest population of 252,000, has a very low population density of 0.18 people per km². This large area combined with sparse population influences the strategy and feasibility of widespread solar installation networks.

Given the Northern Territory’s large geographic expanse and low population density, the focus on renewable energy installations tends to be on individual or isolated projects. This approach differs from more densely populated states where community-level renewable energy initiatives are more feasible.

Despite having one of the highest sunshine exposures in Australia (9–10 hours daily), the Northern Territory has relatively lower total installations. This discrepancy may be influenced by less state focus or fewer incentives for renewable energy, coupled with logistical challenges in deploying and maintaining installations across such a large, sparsely populated area.

The abundant sunshine offers a substantial opportunity for the development of solar energy projects. However, strategic changes may be required in policy and community engagement to harness this potential fully. Enhancing infrastructure to support renewable energy and introducing more robust incentives could increase adoption rates.

Compared to states like Victoria and New South Wales, where urban planning policies and subsidies boost renewable energy installations, the Northern Territory’s approach needs to adapt to its unique demographic and geographical context. The current low installation figures highlight the need for strategies that consider the territory’s vast area and low population density.

total solar installations top 10 suburbs tas

| Rank | Suburb | Jan-23 | Feb-23 | Mar-23 | Apr-23 | May-23 | Jun-23 | Jul-23 | Aug-23 | Sep-23 | Oct-23 | Nov-23 | Dec-23 | Total |

| 1 | Blackstone Heights | 23 | 25 | 39 | 33 | 37 | 34 | 65 | 38 | 34 | 34 | 59 | 44 | 465 |

| 2 | Tranmere | 17 | 24 | 21 | 27 | 20 | 30 | 25 | 29 | 28 | 24 | 41 | 18 | 304 |

| 3 | East Devonport | 17 | 25 | 27 | 7 | 19 | 25 | 16 | 27 | 43 | 33 | 20 | 12 | 271 |

| 4 | Sprent | 10 | 14 | 18 | 14 | 11 | 7 | 14 | 21 | 17 | 13 | 9 | 9 | 157 |

| 5 | Wivenhoe | 6 | 17 | 9 | 5 | 16 | 7 | 19 | 19 | 6 | 7 | 19 | 23 | 153 |

| 6 | Kingston | 16 | 11 | 10 | 14 | 9 | 13 | 7 | 9 | 11 | 11 | 21 | 17 | 149 |

| 7 | Bothwell | 5 | 13 | 16 | 8 | 11 | 10 | 12 | 24 | 14 | 7 | 14 | 13 | 147 |

| 8 | Recherche | 7 | 10 | 12 | 8 | 11 | 7 | 9 | 20 | 7 | 11 | 22 | 14 | 138 |

| 9 | Lenah Valley | 8 | 12 | 14 | 11 | 10 | 6 | 9 | 17 | 10 | 10 | 13 | 11 | 131 |

| 10 | Bakers Beach | 13 | 19 | 9 | 4 | 9 | 11 | 7 | 6 | 8 | 17 | 16 | 11 | 130 |

| 122 | 170 | 175 | 131 | 153 | 150 | 183 | 210 | 178 | 167 | 234 | 172 | 2045 |

| Rank | Suburb | Jan-22 | Feb-22 | Mar-22 | Apr-22 | May-22 | Jun-22 | Jul-22 | Aug-22 | Sep-22 | Oct-22 | Nov-22 | Dec-22 | Total |

| 1 | Blackstone Heights | 16 | 18 | 36 | 22 | 17 | 31 | 21 | 26 | 24 | 30 | 35 | 39 | 315 |

| 2 | East Devonport | 12 | 20 | 14 | 10 | 23 | 15 | 20 | 18 | 17 | 13 | 18 | 21 | 201 |

| 3 | Tranmere | 6 | 16 | 13 | 12 | 17 | 6 | 14 | 13 | 16 | 18 | 22 | 20 | 173 |

| 4 | Bothwell | 8 | 6 | 14 | 13 | 9 | 6 | 9 | 19 | 12 | 16 | 16 | 16 | 144 |

| 5 | Sprent | 7 | 19 | 9 | 3 | 8 | 6 | 6 | 11 | 7 | 8 | 28 | 9 | 121 |

| 6 | Wivenhoe | 3 | 11 | 2 | 11 | 6 | 16 | 22 | 10 | 15 | 7 | 8 | 4 | 115 |

| 7 | Bakers Beach | 8 | 9 | 7 | 4 | 13 | 12 | 10 | 6 | 9 | 7 | 5 | 19 | 109 |

| 8 | Kingston | 4 | 8 | 9 | 5 | 7 | 5 | 6 | 9 | 7 | 9 | 19 | 9 | 97 |

| 9 | Recherche | 4 | 9 | 4 | 2 | 7 | 9 | 10 | 7 | 9 | 7 | 15 | 13 | 96 |

| 10 | Lenah Valley | 6 | 7 | 5 | 5 | 8 | 3 | 7 | 3 | 4 | 5 | 8 | 14 | 75 |

| 74 | 123 | 113 | 87 | 115 | 109 | 125 | 122 | 120 | 120 | 174 | 164 | 1446 |

| Rank | Suburb | Jan-21 | Feb-21 | Mar-21 | Apr-21 | May-21 | Jun-21 | Jul-21 | Aug-21 | Sep-21 | Oct-21 | Nov-21 | Dec-21 | Total |

| 1 | Blackstone Heights | 14 | 29 | 24 | 23 | 43 | 34 | 42 | 36 | 35 | 26 | 34 | 25 | 365 |

| 2 | Tranmere | 8 | 6 | 15 | 25 | 18 | 9 | 13 | 6 | 17 | 8 | 14 | 20 | 159 |

| 3 | East Devonport | 5 | 13 | 17 | 13 | 18 | 10 | 20 | 14 | 18 | 13 | 12 | 19 | 172 |

| 4 | Bothwell | 7 | 24 | 16 | 12 | 16 | 10 | 16 | 11 | 12 | 7 | 15 | 10 | 156 |

| 5 | Kingston | 6 | 8 | 9 | 13 | 15 | 5 | 12 | 14 | 18 | 4 | 18 | 10 | 132 |

| 6 | Sprent | 4 | 7 | 14 | 11 | 13 | 12 | 9 | 7 | 10 | 10 | 11 | 8 | 116 |

| 7 | Bakers Beach | 3 | 3 | 10 | 15 | 5 | 13 | 7 | 12 | 3 | 11 | 8 | 9 | 99 |

| 8 | Recherche | 1 | 4 | 11 | 11 | 8 | 6 | 11 | 11 | 2 | 10 | 8 | 13 | 96 |

| 9 | Wivenhoe | 6 | 9 | 7 | 3 | 5 | 4 | 7 | 8 | 10 | 5 | 12 | 8 | 84 |

| 10 | Lenah Valley | 4 | 8 | 5 | 5 | 5 | 5 | 5 | 6 | 3 | 5 | 11 | 6 | 68 |

| 58 | 111 | 128 | 131 | 146 | 108 | 142 | 125 | 128 | 99 | 143 | 128 | 1447 |

| Rank | Suburb | Jan-20 | Feb-20 | Mar-20 | Apr-20 | May-20 | Jun-20 | Jul-20 | Aug-20 | Sep-20 | Oct-20 | Nov-20 | Dec-20 | Total |

| 1 | Blackstone Heights | 13 | 26 | 23 | 20 | 25 | 22 | 26 | 16 | 18 | 22 | 34 | 32 | 277 |

| 2 | East Devonport | 6 | 14 | 10 | 9 | 9 | 9 | 15 | 9 | 12 | 8 | 19 | 13 | 133 |

| 3 | Tranmere | 17 | 6 | 13 | 7 | 8 | 3 | 4 | 13 | 12 | 10 | 12 | 14 | 119 |

| 4 | Bakers Beach | 6 | 8 | 12 | 6 | 5 | 9 | 5 | 8 | 12 | 6 | 19 | 9 | 105 |

| 5 | Bothwell | 8 | 9 | 7 | 7 | 7 | 4 | 7 | 10 | 8 | 6 | 13 | 14 | 100 |

| 6 | Kingston | 11 | 10 | 12 | 5 | 5 | 7 | 7 | 9 | 7 | 12 | 8 | 6 | 99 |

| 7 | Sprent | 7 | 4 | 10 | 13 | 2 | 7 | 11 | 7 | 9 | 6 | 10 | 7 | 93 |

| 8 | Wivenhoe | 6 | 7 | 8 | 8 | 7 | 5 | 4 | 4 | 7 | 7 | 7 | 13 | 83 |

| 9 | Recherche | 4 | 6 | 8 | 7 | 8 | 4 | 6 | 4 | 7 | 6 | 11 | 5 | 76 |

| 10 | Lenah Valley | 4 | 8 | 1 | 2 | 8 | 3 | 1 | 1 | 8 | 5 | 3 | 3 | 47 |

| 82 | 98 | 104 | 84 | 84 | 73 | 86 | 81 | 100 | 88 | 136 | 116 | 1132 |

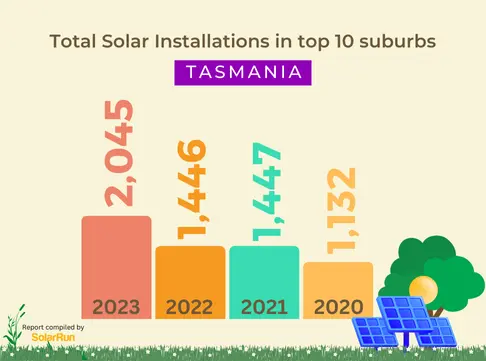

Based on the data provided for the top 10 suburbs in Tasmania from 2020 to 2023, here are some observed trends regarding solar installations:

The total number of installations across the top ten suburbs in Tasmania between 2020 and 2023 is 6,070.

Blackstone Heights has shown a consistent increase in solar installations over the years, with notable jumps each year. This suggests a growing trend towards renewable energy in this suburb.

Suburbs like Tranmere, East Devonport, and Sprent have shown gradual increases in solar installations year over year. This steady growth indicates a sustained interest in solar energy.

Lenah Valley and Recherche suburbs show more variable year-on-year changes, including some declines in installations. This variability could be influenced by factors such as local economic conditions, housing developments, or changes in local policies regarding renewable energy.

Kingston displayed a significant increase in solar installations in 2021 compared to 2020 but saw a drop in subsequent years. This might indicate an initial surge due to incentives or programs that may not have sustained.

The total number of installations has grown from 2020 to 2023, indicating an increasing acceptance and investment in solar technology across these top suburbs in Tasmania.

Tasmania, with its area of 68,401 km² and a population of 573,000, has a population density of 7.55 people per km². This relatively low density, combined with a strong community engagement and state-level incentives, influences the strategy for deploying renewable energy installations.

Tasmania’s leadership in renewable energy is evident, with 100% of its electricity sourced from renewable resources. The high per capita installations reflect the state’s commitment and effective policies towards renewable energy, which is further supported by the community’s active participation.

Despite lower sunshine hours (5 to 7 hours daily), Tasmania has effectively utilised its abundance of fresh water to power hydroelectric projects. This is part of a broader strategy to not only meet local energy needs sustainably but also to exceed them, with goals set for a 200% renewable target by 2040.

We are available! Have a question? Text us here.

Text Us

Text Us