Why solar is the best protection from looming electricity price hikes

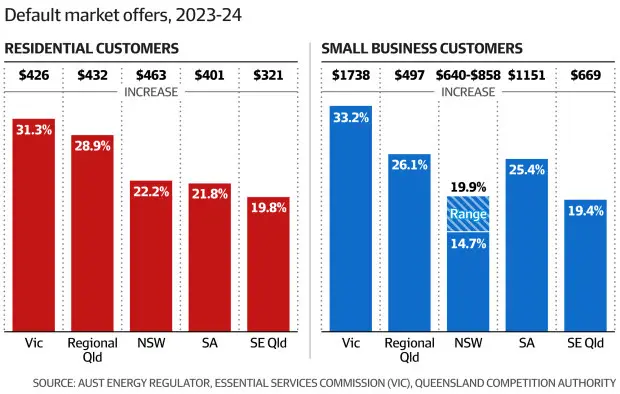

Households and small business along the east coast of Australia are bracing themselves for power bill increases of up to 31 per cent from July 1. Energy regulators have released their draft decisions to raise benchmark electricity prices by 19.8 per cent to 22.2 per cent in New South Wales, south-east Queensland, and South Australia. Victorians are hardest hit with an expected 30 per cent jump.

With cost-of-living-pressures putting many households and businesses under stress, this is the last thing anyone wants to hear. This blog takes a good hard look at what these draft decisions mean and what you can do to sidestep them with the help of the right solar power system.

What is a benchmark price?

The Australian Energy Regulator (AER) and in Victoria, the Essential Services Commission (ESC), set a benchmark price – also known as a reference price or default market offer (DMO) – which is the maximum amount electricity retailers can charge customers who are on standing offers.

Around 10 per cent of Australian households are on standing offers. Typically, these are households who haven’t shopped around for a cheaper electricity deal for some time.

Those who do shop around typically save themselves 8 to 10 per cent off the standing offer price.

Retailers typically use the benchmark price as a reference. When it goes up, the market offers (i.e., more competitive electricity deals) generally increase as well.

“It’s important to understand that the default market offer is not the best offer, it is a safety net. We encourage consumers to shop around for the best electricity deal for your circumstances,” said AER Chair Clare Savage in a press release.

How much will my bill increase by?

The draft decisions signal an increase of between $320 to $460 for residential customers and $669 to $1,738 for small businesses on standing offers. The actual increase depends on which region you are located in, with Victorians and regional Queenslanders being hit with the biggest price hikes.

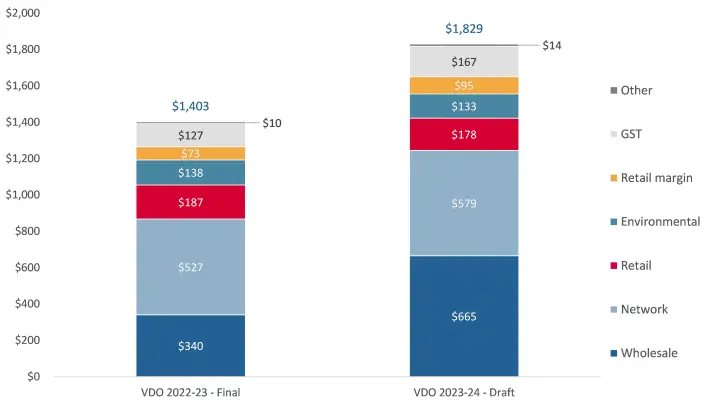

For example, the average Victorian household electricity bill is predicted to increase from $1,403 in 2022-23 to $1,829 in 2023-24 for those 400,000 Victorian homes on the Victorian Default Offer.

So, if your home uses 11 kilowatt hours of electricity a day on average throughout the year, that’s probably what you’ll be paying if you live in Victoria and you haven’t shopped around for a cheaper electricity deal for some time.

If you own a small business in Victoria and your average annual electricity usage is 20,000 kilowatt hours a year – or 55 kilowatt hours a day – your bills are projected to increase to $7,358 in 2023-24, compared to $5,620 the previous year if you’re on a standing offer.

What’s causing these massive price hikes?

Network costs (i.e., the costs of poles and wires) have traditionally been the biggest cost element affecting electricity prices. But now, thanks to our exposure to volatile global energy markets caused by the Ukraine war and structural issues in our domestic energy markets, wholesale electricity prices have surged. And it is this massive increase in wholesale energy prices that’s the biggest contributor to skyrocketing power bills.

The Victorian Essential Services Commission has published a useful chart (see below) that highlights the contributing elements to the increase in residential electricity bills. This shows that surging wholesale electricity prices are the main reason for the massive increase in power bills that Victorian homes are likely to face in the coming year.

Are these bill increases guaranteed to happen?

The good news is that these price increases aren’t set in stone – as yet. They are draft decisions, with the final decisions due to be announced in May 2023.

Having said that, we are being told to be thankful that the draft price increases aren’t as high as they might have been. According to the Australian Energy Regulator, if the federal government hadn’t stepped in with legislation to cap energy prices in December 2022, we could have been facing price hikes of around 50 per cent in the coming year.

It’s also worth knowing is that last year, the energy retailers successfully argued for an increase in the draft default prices.

What’s to stop them trying the same tactic this year?

How can solar help me avoid rising power bills?

If feeling like you’re at the mercy of unstable international and domestic energy markets – not to mention the big energy retailers – you’re right. Whilst Australia has ambitious targets to transition the national electricity market to renewables, there’s still some way to go. It could take 5 or even 10 years before the promised low electricity prices from a renewables-led grid flow through to household power bills.

That’s why solar is such a good investment.

With a large enough solar panel system you can neatly sidestep the need for (virtually any) grid electricity during daytime sun-producing hours. If your household uses the most electricity during the evening, a solar battery could save you from drawing on grid electricity during the evening peak. A 10kW solar panel system and a 10 or 13 kWh solar battery is enough for most households to reduce their total grid electricity usage by as much as 80 per cent – or even more!

A tip for solar battery owners: You can make the biggest bill savings by switching to a time-of-use tariff. That allows you to use your battery to power your home during the expensive weekday evening peak period (3pm to 9pm), and benefit from the lower shoulder and off-peak rates for the rest of the time.

Solar: the best insurance from energy price volatility

If you’re sick of rising energy costs, the best way to get off the escalator is solar. Solar panel systems typically have a payback of 3 to 5 years. Solar batteries are more expensive but the break-even point can be within the typical 10-year warranty period – or even quicker. And the massive advantage of a home solar battery is the peace of mind you get from knowing you’ve fixed your energy costs at the lowest possible level. So next year when the energy regulators announce their price rises, you won’t care a bit!

Request a quote

If you want protection from energy price increases, talk to a solar expert at SolarRun. We can design a solar panel or solar-plus-battery system that reduces your electricity bills to next-to-nothing and provides you with bullet-proof insulation from volatile electricity markets and unexpectedly high power bills.

Don’t wait. Every day without solar is another day you’re paying too much for electricity..

We are available! Have a question? Text us here.

Text Us

Text Us

Don’t wait. Every day without solar is another day you’re paying too much for electricity..

Hi my friend! I want to say that this post is amazing, great written and come with approximately all important infos. I’d like to peer extra posts like this .

You are my aspiration, I have few web logs and infrequently run out from to brand : (.

You’ve wrecked me for all alternative authors in this sphere!

Nobody can contend with your quintessential examination.

You succeed to make any matter fascinating and thought-provoking.

You’re genuinely one of a kind!

You actually make it appear really easy along with your presentation but I in finding this topic to be actually one thing that I feel I’d by no means understand. It seems too complicated and extremely vast for me. I am looking forward on your subsequent put up, I will try to get the grasp of it!

Lump sum home loan repayments can only be produced on the

anniversary date for closed mortgages, open mortgages allow whenever.

Income properties demand a larger advance payment of 20-35% and private mortgage lenders limit borrowing determined by projected rental income.

Vital prescription expenses arise suddenly, but Canadians get help covering

costs through emergency payday loans from reliable lenders.

Bad credit history and scores usually do not prevent

approval for online payday advance available anytime to provide immediate access to borrowed funds when expenses cannot

wait. High approval emergency loans from online lenders offer Canadians fast entry to borrowed funds by focusing read more about urgency than stringent credit checks only.

My spouse and I stumbled over here from a different web address and thought I might as well check things out.

I like what I see so i am just following you.

Look forward to looking into your web page for a second time.

Hello, Neat post. There is a problem together with your website in web explorer, might test

this? IE nonetheless is the market leader and a good portion of people will leave out your excellent writing

because of this problem.

Mortgage default insurance protects lenders from losses while allowing high ratio mortgages with less than 20% down. Mortgage qualification rules were tightened considerably after 2016 to cool overheated markets. Maximum amortizations were reduced through the government to limit taxpayer contact with mortgage default risk. Mortgage applications require documenting income, tax returns, down payment sources, property value and overall financial picture. Payment frequency options include monthly, accelerated biweekly or weekly https://www.youtube.com/watch?v=Mh94Dy5PFrQ cut back amortization periods.