Australian households looking to get solar panels can access government rebates and incentives that cut the cost of going solar.

There are three types of solar panel rebates and incentives available to Australian households:

On this blog, we explain what each rebate or incentive is, what it is worth, and how to claim it.

There are federal and state government rebates available for Aussie households who want to install a solar panels system. These rebates reduce the cost of rooftop solar, by around 30 per cent or more.

Federal government solar rebate

This rebate is available Australia-wide on solar panel systems under 100kW in size. Technically, this is not a solar rebate; the official name for this federal government incentive is Small-scale Technology Certificates, or STCs.

STCs are worth around $430 for every kilowatt of solar panels installed. For example, if you installed a 10kW solar panel system, the STC rebate is worth around $4,300. This brings down the price of a mid-range 10kW solar PV system to approximately $9,500. Without the STC rebate, the price would be around $13,800 – so this rebate is worth having!

Anyone installing a grid-connected solar panel system will be eligible for this rebate – regardless of where they live in Australia. The only eligibility criteria are that the solar panels and solar inverter are on the approved product list of the Clean Energy Council and that the system is installed by an accredited Clean Energy Council installer.

The way STCs work is like a point-of-sale discount. You don’t get a cheque in the post. Instead, you sign over the STCs for your system to your installer who batches them up and them trades them in. When you see the prices of solar power systems advertised, it will always be after the value of the STCs has been deducted.

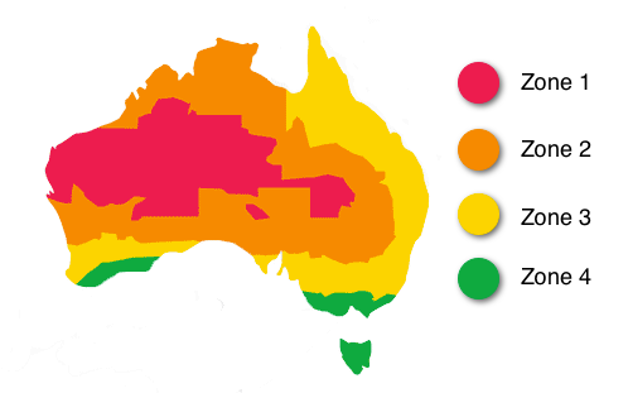

The value of STCs will depend on your geographic location, the date your solar system is installed and the market value of STCs. If you live in the sunniest parts of Australia, the STCs for your solar system will be worth more – and if you live down south, the STCs will be worth a bit less.

If you request a quote from SolarRun, you will clearly see the number and value of STCs for your proposed solar panel system as a line item in the quote.

STCs are based on the Zone you live in. Zone 1 qualifies for the highest value of STCs; Zone 4 has the lowest value. Regardless of which Zone you live in, STCs provide a significant reduction in the cost of a solar panel system.

STC Zone Map of Australia

STC Zone map

The STC scheme is gradually being phased out and will end in 2030. Each year on the 1st of January, the value of STCs reduces by around 10 per cent as part of the phase out program.

Act now to install solar – and get the STCs at their current higher value.

State government solar panel rebates

Two state governments provide solar panel rebates: Victoria and NSW.

Victoria

The Victorian solar panel rebate is administered through the state government’s Solar Homes Program. This 10-year program provides a rebate on solar panel installations for homeowner and rental properties worth up to $1,400.

The rebate works as a point-of-sale discount. The eligibility criteria are more extensive than for the STC rebate, but basically you need to have a household income of less than $180,000, a property worth under $3m – that doesn’t have solar panels on it. However, early adopters of solar who installed their systems over 10 years ago may be eligible.

This rebate is one you need to apply for via the Solar Homes program. You must have your eligibility approved by the Solar Homes program prior to having your system installed.

If you’d like help with the application process, get in touch with the team at SolarRun or check out the Solar Home website.

NSW

The NSW government offers a Solar for Low Income Households program which is currently available in selected locations in the state but will widen over the next 12 months to include households in more parts of NSW. This offer helps homeowners on low incomes reduce their electricity bills by installing 3 kilowatt solar systems on their homes. For more information, get in touch with SolarRun or visit the NSW government website.

The only state government to provide an interest-free loan for residential solar panel system is the Victorian government. This loan is available to households who apply for the solar panel rebate at the same time. The application process is straightforward and, if eligible, the value of the loan is deducted from the price of your solar system.

A feed-in tariff is the rate you are paid for any electricity generated by your solar panel system that is exported to the grid.

Feed-in tariffs are not a rebate. Rather, they are an ongoing financial credit you receive in return for surplus electricity your solar system is allowed to send to the grid.

Feed-in tariffs vary state by state. They also vary between electricity retailers.

Some state government set a mandated minimum value for the feed-in tariff (these change from time to time). Retailers can of course choose to pay their customers the minimum – or offer a bit more.

Other state governments don’t set a minimum feed-in tariff. Electricity retailers therefore set their own offers for recompensing householders for their solar electricity.

Solar feed-in tariffs: state by state as of May 2022

| State | Mandated minimum Feed-in Tariff | Value of mandated minimum Feed-in Tariff |

| Victoria | Yes | 6.7 cents per kilowatt hour |

| NSW | No | NA |

| QLD | No | NA |

| ACT | No | NA |

| NT | No | NA |

| South Australia | No | NA |

| Tasmania | No | NA |

| WA | No | No |

Note: It is always worth checking every aspect of the deal with your electricity retailer as some may offer a high feed-in, but raise the daily supply charge or the rate for grid electricity.

If you are installing a battery as well as solar panels, you may be eligible for a battery rebate. Likewise, if you’re upgrading to an energy-efficient hot water heat pump system, there may be rebates you can get which will cut the purchase price.

Businesses can also access valuable rebates for commercial solar panel and battery storage systems.

To learn more about other types of rebates you may be eligible for, get in touch with the team at SolarRun today. We’ll be able to explain exactly what rebates you can access, their value and the reduction this will be on the cost of your solar system.

Acting now to secure government rebates is always a good idea, as the value of government incentives can change from time to time.

And, of course, the sooner you get solar, the sooner you cut your electricity bills.

We are available! Have a question? Text us here.

Text Us

Text Us

Hey very cool blog!! Man .. Excellent .. Amazing .. I will bookmark your website and take the feeds also…I’m happy to find numerous useful information here in the post, we need develop more techniques in this regard, thanks for sharing. . . . . .